Terravest Industries in trouble

Short term hurdle or long term pain?

During the last 2 months we have seen $TVK share price move from $138 as low to $102 and the biggest question on everyone mind is if tariffs and the tension with the USA gonna impact the company long term or provide a rare buying opportunity?

A brief introduction

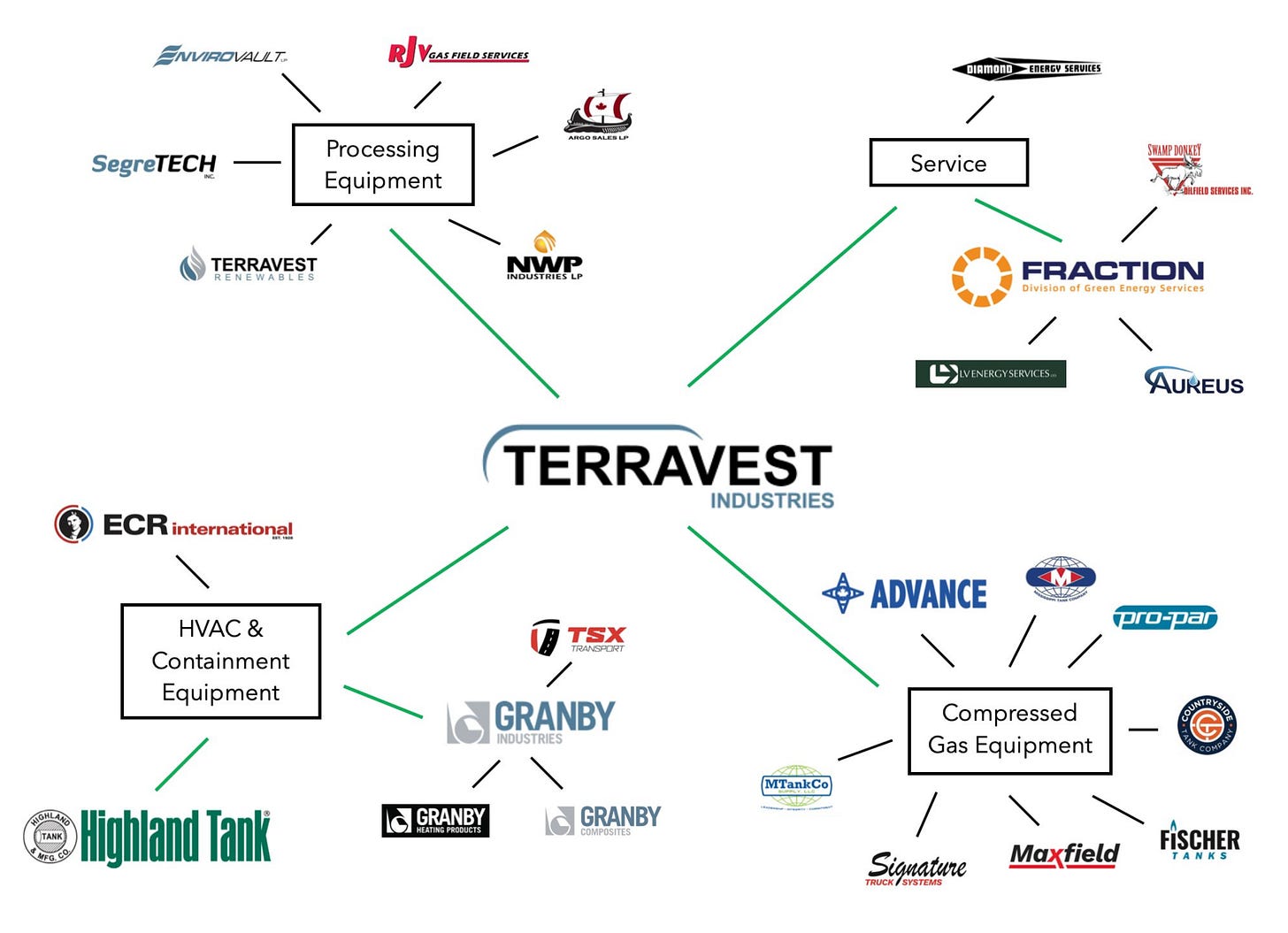

TerraVest Industries is a diversified manufacturer of sophisticated steel and related products such as tanks for storage of heating oil, containers for transport for compressed gases and well head equipment. The company also provides certain specialised services to the oil and gas industry and more that will be covered in deep dive as I own and am very familiar with the company.

They do acquisitions of smaller companies within their very tight niche (which they dominate) which they fit under their portfolio and fuel their compounding.

Credits - CJ0pp3l on twitter for the picture!

I think the picture perfectly encapsulates the scale and diversity of Terravest which majority of people believe it is just a propane tank maker, which of course is a mistake!

The issue

Without commenting on politics (I hate them and consider them a waste of time) Trump has started a tariff war with Canada. I will break down all the tariffs imposed thus far and how they will likely be impacting Terravest.

Specifically

February 1, 2025: President Donald Trump signed executive orders imposing a 25% tariff on all goods imported from Canada, with a 10% tariff specifically on Canadian energy exports, including electricity, natural gas, and oil.

March 4, 2025: The U.S. tariffs officially took effect. In response, Canada implemented 25% tariffs on $30 billion worth of U.S. goods, with plans to extend these measures to an additional $125 billion in the following three weeks.

March 11, 2025: Escalating the trade tensions, President Trump announced an increase in tariffs on Canadian steel and aluminum imports to 50%, effective immediately. This decision was a direct response to Ontario's surcharge on electricity exports to U.S. states.

Please note these facts will be likely be outdated very soon but I believe it is the best opportunity to address how they can’t impact the company

A short trip to the past

While investigating the past we can get a lot of clues for how a situation played out and get a glimpse of what it is to come, while not obsolete it is often very helpful especially if we have a similar scenario.

And we have almost the exact playbook unravel in 2018 during the first presidency of Trump.

Trump administration in 2018 placed heavy tariffs on Canadian exports, most notably 25% tariffs on steel and 10% on aluminum. Canada retaliated with equivalent tariffs on U.S. goods (including steel, aluminum, and various consumer products) starting July 2018. While short lived (close to a year) it caused significant volatility in supply chains and input costs. Notably, Canadian steel exports to the U.S. fell ~38% immediately after tariffs and hit a 10-year low by May 2019.

So we have seen this scenario play exactly the same before!

Effect per segment

Fuel Containment & HVAC Products (Propane Tanks, Fuel Tanks, Boilers)

I consider this segment to be their bread and butter

This segment manufactures propane and anhydrous ammonia transport trailers, bulk storage tanks, residential tanks, as well as furnaces and boilers. Their characteristic is them being steel-intensive and of course the tariffs raised their raw costs.

Specifically —> The cost of steel plate and coils (critical for tank fabrication) rose significantly, squeezing manufacturing margins. At the same time, Canada’s retaliatory tariffs on U.S. steel meant any steel TerraVest imported from the U.S. carried an extra 25% duty. This forced TerraVest to seek alternate suppliers or pay higher prices domestically. In practice, TerraVest’s production of propane tanks and fuel containers became more expensive, and logistical snags emerged.

Worth noting that the demand did not change for the products during this time, it was still strong. Heating segment saw similar margin pressure as the company tried to balance some of the costs without putting too much pressure on the consumers.

Energy Processing Equipment (Oil & Gas Equipment Manufacturing)

TerraVest’s processing equipment segment makes wellhead separators, treaters, processing tanks, and large-scale NGL/propane storage units, among other custom equipment.

This business is also highly dependent on steel (for pressure vessels, piping, structural skids, etc.), so the 25% steel import tariff hit its cost of goods sold significantly. Management explicitly warned in mid-2018 that new import tariffs and deteriorating trade relations added “additional uncertainty around access to raw materials,” expecting a negative impact on the company moving forward

Specifically —> Not only it created issues for costs but also the supply chain availability, as specialty components (which they operate in) could have been harder to procure if supply was diverted or limited by quotas.

To tackle this Terravest worked closely with suppliers, with which I may add has very close ties since they are a complete monopoly in their field. This works in their favour as they can more effectively tackle this situation. Worth mentioning that they get steel much cheaper than the competition, close to 20% cheaper, this will come in handy if tariffs persist long enough

Service Segment (Oilfield Services)

The services segment is the smallest segment within TerraVest. It provides energy producers within Western Canada with services such as fluid hauling, water management, environmental solutions, heating, rentals and well servicing.This segment was less directly exposed to tariffs since it provides labor and service rather than manufacturing. However, it still felt in 2018 second-order effects. The trade war dampened oil prices or producers’ cash flows, drilling and well-servicing demand declined. I don’t think that this segment will be directly be impacted a lot!

Time to see scenarios

There are a lot of variables that come into play here, we will just accept that tariffs do take place and will be like that for a while

In 2018 the trade war forced TerraVest to adjust its inventory and supply chain strategy. Fearing steel shortages or further price spikes, the company may stockpiled raw materials, tying up cash in inventory. Conversely, when supply was uncertain, production schedules could be disrupted, leading to higher work-in-progress inventory and receivables. These factors were evident in TerraVest’s cash flow. In the quarter tariffs began (summer 2018), TerraVest’s operating cash flow was actually negative but in 2019 when the tariffs were lifter op cash flow jumped 298%.

Management reacted by

Adjusting their supply chain and secure alternative supplies from countries not affect by Canadian retaliatory tariffs & worked with suppliers and the government directly.

During 2018-2019 they didn’t lose significant volume due to pricing, meaning they managed to retain customers while adjusting contracts as needed 14% rise in sales in fiscal 2019, TerraVest’s organic sales (excluding acquisitions) were flat. Adjusted ebitda still grew in 2018-2019.

They improved operations: During Q4 of that year, TerraVest paid capital expenditures related to a major capital project completed in the third quarter that involved transferring petroleum tank production to a new facility. Additionally, TerraVest expanded its desanding rental fleet. These growth projects are expected to result in increased capacity and greater efficiencies in several of TerraVest's businesses.

Expanded the business with some very smart acquisitions - On Aug. 30, 2019, a subsidiary of TerraVest entered into an acquisition agreement to acquire substantially all the assets of Iowa Steel Fabrication, doing business as Countryside Tank and Majona Steel Corp. ISF is an Iowa-based company primarily focused on manufacturing transportation equipment for the propane and anhydrous ammonia markets, as well as structural steel projects.

This is very interesting because as I view it, it gave TerraVest a U.S. manufacturing footprint for propane trailers. This move can help alleviate future tariffs pressure – if trade barriers return, TerraVest can build products within the U.S. for U.S. customers, reducing cross-border exposure. It also broadened their product line and customer base, making the company less vulnerable to any single region’s trade policy. In essence, TerraVest became more intergraded in the US market

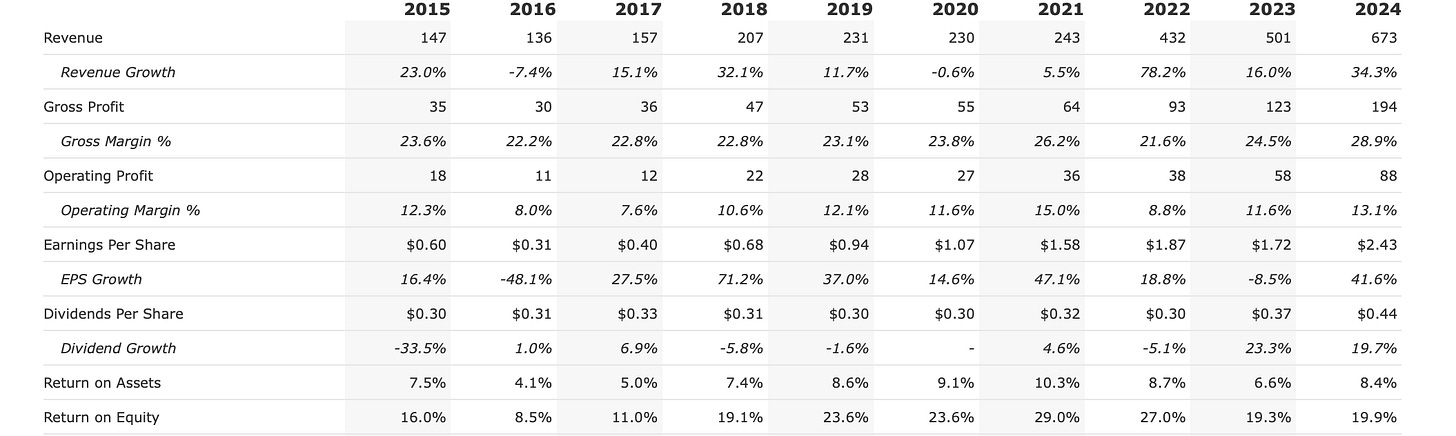

Source: Terravest Website!

Bottom line

I will keep it short and sweet as always, in my view there could be more short pain for the company but given how they managed similar situations in the past I believe they are well positioned (more than ever) to tackle this issue.

Any price under $90 I will be a buyer of the business adding my already existing position. I fully trust the management as in the past they have aggressively bought back the business when the market heavily discounted the share price.