Deep Into the Ocean

ITECH.ST Deep Dive

Chapter 1 | Introduction and Expectations

Welcome everyone to another Report! Been a while since the last deeper look, and I have honestly missed uncovering data and exploring unique businesses.

While all the previous reports have been (besides one) on SaaS stocks, this time I am doing something different. Most of the people who follow me on X are aware of this one, as I have covered it.

My main goals with this thesis are

Explain the Business Model and the general field in which they operate.

Explain the recent troubles and the risks behind them.

Examine the growth opportunities.

I want to thank Markus Jönsson, the CEO of the company, for the in-depth interview he gave me.

I would also like to thank Assaf Nathan, an institutional investor in ITECH. He was willing to help me with some questions.

If you are already a shareholder or interested in the company, i believe that you will find valuable information here.

As with every report, there is an aspect that will prove to be the most challenging. In this one, it was about processing the immense information flow from different fields and pinpointing the essential pieces of the puzzle, and this is what makes research so exciting to me.

This report was written with a specific structure in mind, so it makes sense to read it from start to finish, as it follows a precise flow. Reading specific parts, although insightful, is not suggested.

Hope y’all will enjoy, grab a warm coffee, and let’s examine.

Stats 📊

Ticker - $ITECH.ST

Index - Nasdaq First North Exchange (Stockholm)

Public - 2019

Share Price - 51 SEK

Analysts PT - 86

Coverage - Red Eye Small Cap Research

Market Cap - 616mil SEK (68mil in USD)

Listed on - Nasdaq First North

Shares Out - 12.000.000

Revenue Growth LTM - 27.4%

P/E - 15

Gross Margin - 56.09%

Debt - 0

Cash - 135mil SEK / 14.5m USD

Insider ownership - 5.1% Including board and Management

Institutional ownership - 45%

Chapter 2 | Idea Discovery & Brief History

I came across ITECH earlier this year after speaking with a friend, who told me to look at this small-cap in Sweden. It filled most of the criteria I look for in a company, but we will discuss that later.

I invested initially at around 80 SEK. The company performed very strongly until 125 SEK, but is now trading at 56 SEK per share following some unfavorable recent developments.

But we shall not rush, let’s cover the basics,

They are a chemical company, and their main product (and only for now) offering is a biochemical product called Selektope, embedded in ship paint to help reduce barnacle coverage on ships’ crucial surfaces (mainly the hull), which causes significant issues for the ship industry. The active ingredient responsible for its repellent properties is called Medetomidine, and you should remember that for later!

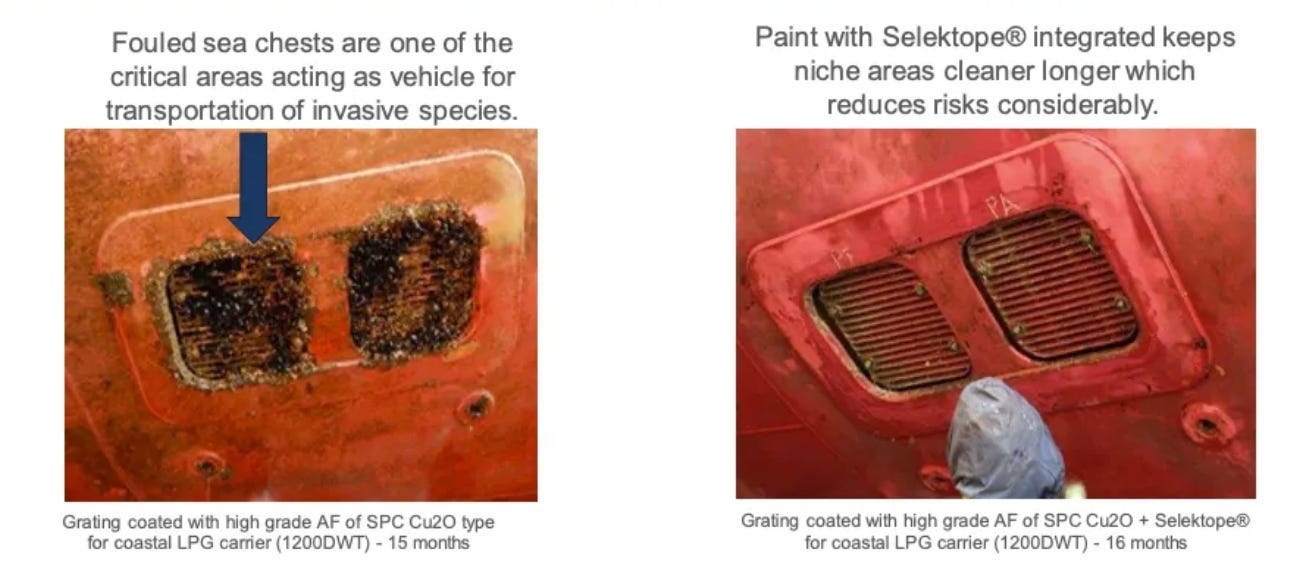

Picture 1 - The Key function, Source ITECH

As shown in the picture, the arrow points to the area where Selektope has been applied, illustrating its purpose. As the deep dive progresses, I will explain the function and its dynamics in more depth.

ITECH, as a company, was officially formed in 2000 (the same year they filed for their first patent). Early on, I-Tech received seed funding from multiple key Swedish companies (Volvo, MISTRA, the Foundation for Environmental Strategic Research, etc).

Selektope was approved for the first time in 2016, in classic European fashion, regulatory scrutiny plagued the company for a while. In 2014, Selektope was officially adopted by Chugoku Marine Paints (CMP), which, besides being the first, remains the largest client to this day. Please note that the regulatory scrutiny aspect is gonna be helpful for the later parts of the thesis.

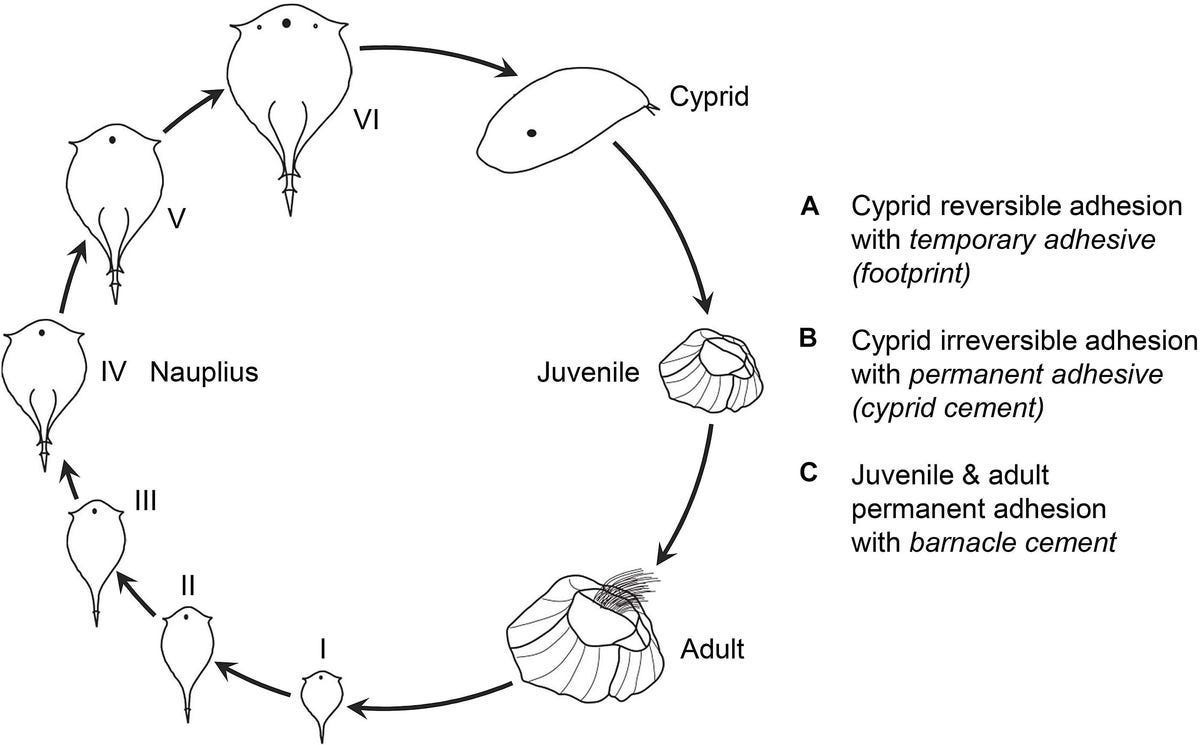

The creation of the company is the by-product of research conducted at the University of Gothenburg from 1990 to 2000. The main discovery in the research papers was the unique effect of medetomidine (the primary chemical compound used in Selektope) on cyprid larvae (the organism responsible for the formation of sea barnacles).

The original paper tested 6 substances for their potential effectiveness against barnacle fouling. Medetomidine came out as the most effective solution for the following reasons.

The concentration required to kill the larvae is 200,000 times higher than the concentration needed to stop them from settling. This means it prevents fouling without killing organisms, unlike heavy metals such as copper or TBT. If the larvae are removed from the substance, they recover and usually settle on other surfaces.

Extremely low concentrations were required (1 nM), which is 1000 times lower than the effective dose of other substances, such as Phentolamine. Great for storage and efficiency purposes, but we will examine it more closely at a later stage.

Strong tendency to accumulate at the interface between the solid surface and the water. This makes it ideal for use in marine paint coatings because it stays on the surface, where larvae try to attach. (Source)

Medetomidine, as a substance, is not new, nor does it have finite uses. It is still used today by vets as a mild sedative for dogs and cats, for minor surgery or exams such as X-rays.

The more purified form of Medetomidine is dexmedetomidine, and it is the most widely used drug in ICUs today. Unlike other sedatives, patients remain aware and can answer questions, which, as you can imagine, is very important for nurses/doctors to assess brain health and function.

It is preferred over other sedatives because, unlike Medetomidine, they have a powerful effect and puts the patient in a coma-like state.

Chapter 3 | Problem & Solution

3.1 - Problem

If you aren’t familiar with the case, you are likely and rightfully thinking —> how much of a vital/crucial problem can barnacles under ships be, what is the main issue the company strives to solve?

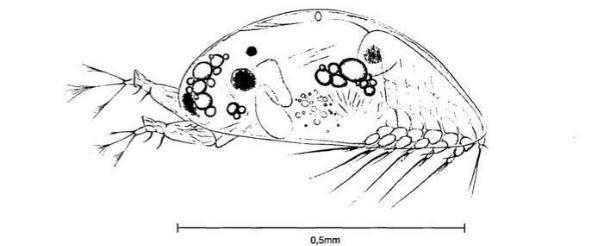

Picture 2, The problem - A drawing of a cyprid larva. Honoring the initial research that made the discovery, I have included the larva depiction from within the report.

Given its size, please don’t mistake it for a tiny one. Cyprids are an essential part of the puzzle the ship industry is facing —> biofouling.

This small larva can cause what Picture 3 showcases (the larger the vessel, the more powerful the problem is)

Picture 3 - Barnacles in the Hull area, Source ITECH

Now, let me walk you through what biofouling is.

Biofouling is a process/phenomenon that, according to the official definition,

‘‘The accumulation of aquatic organisms such as microorganisms, plants, and animals on surfaces and structures immersed in or exposed to the aquatic environment.’’

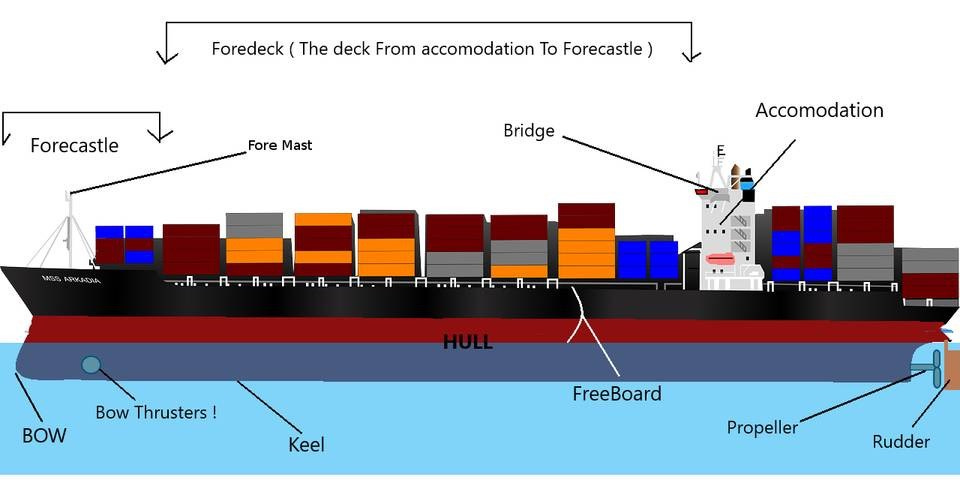

In large ships (tankers and cargo ships), which represent the key client (will explain why), the area that stays submerged for the most amount of time is the Hull and more specifically the Keel and Bottom Shell Plating. For demonstration purposes, check picture 4 (in the bottom area).

Picture 4 - Areas of the Ship

The red area is the hull, where the protective paint is applied.

Why? The hull’s bottom is the area where most barnacle activity takes place, which is logical, given that it is the area that spends more time submerged and is also the smoothest (important). This, alongside other characteristics that we will examine later, is very favorable for barnacle growth.

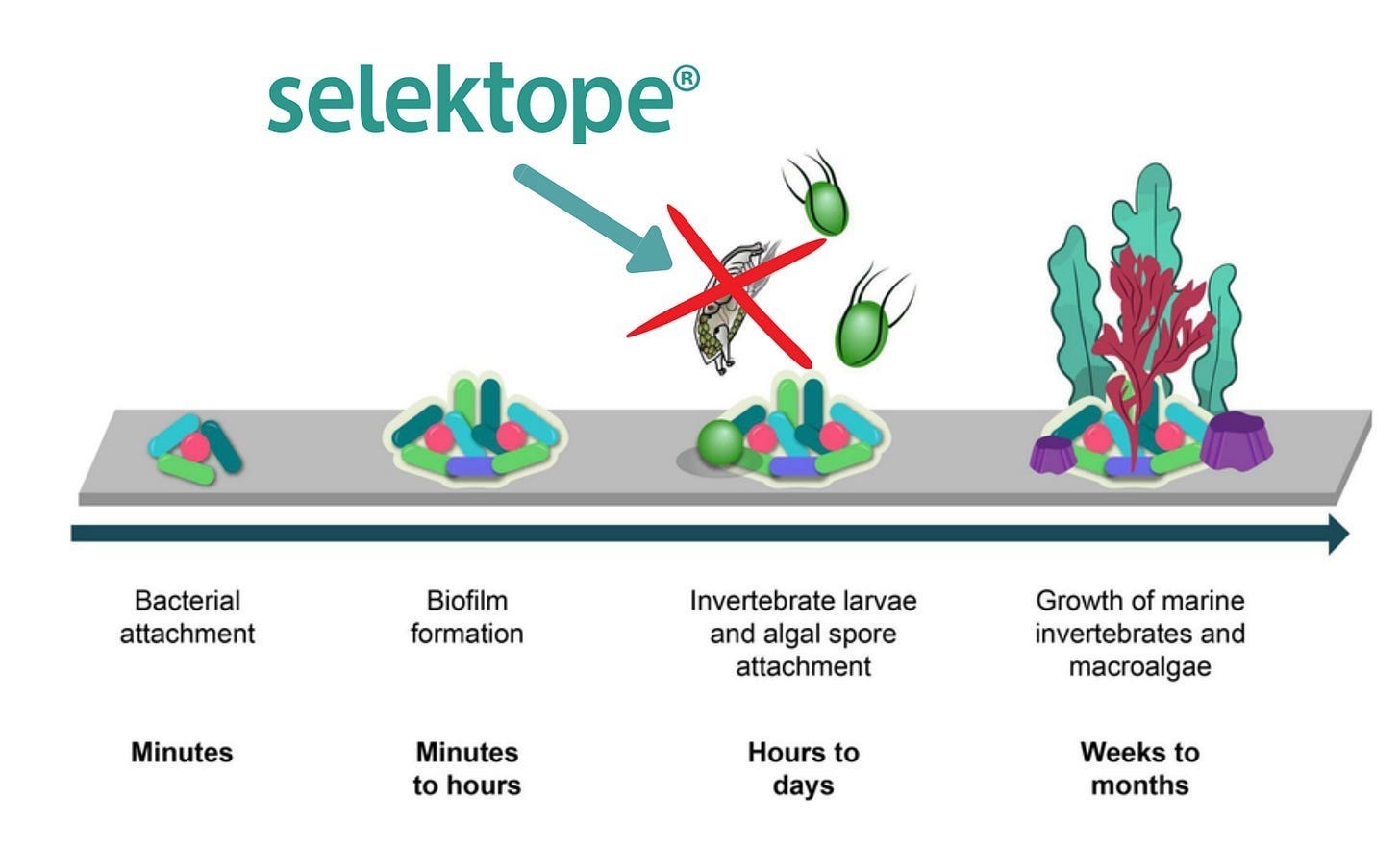

3.2 - Process of Biofouling

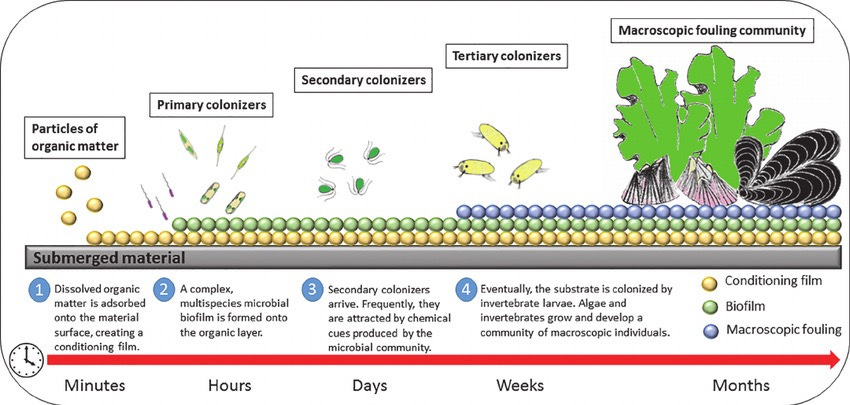

Picture 5 - The layers of biofouling, Source

The process is vital to understanding ITECH, as it is the problem that they have created the solution to. Picture 5 clearly shows how biofouling evolves, with multiple layers that build on each other, gradually worsening the negative effects.

As is clear in stages 1-4, the deciding factor in assessing biofouling is submerged time. If you are not proactive, this is an unavoidable and serious problem for the marine industry.

But first, to better understand the process.

I want to draw your attention to the three fouling layers, which represent the process stages.

🟡 - Conditioning film

🟢 - Biofilm

🔵 - Macroscopic fouling

It all begins with the conditioning layers, which are the foundation for what follows, it starts the very minute a ship submerges in the ocean. This film is composed of organic proteins that accumulate on the surface, forming a sticky layer that allows bacteria and diatoms to colonize and create slimy biofilm matrix over the next few hours. This enables the chemical and physical settlement of the real issue, heavy macro-foulers like barnacles and mussels in the weekly stage, which create the real issue for the ship industry, more on that in a bit.

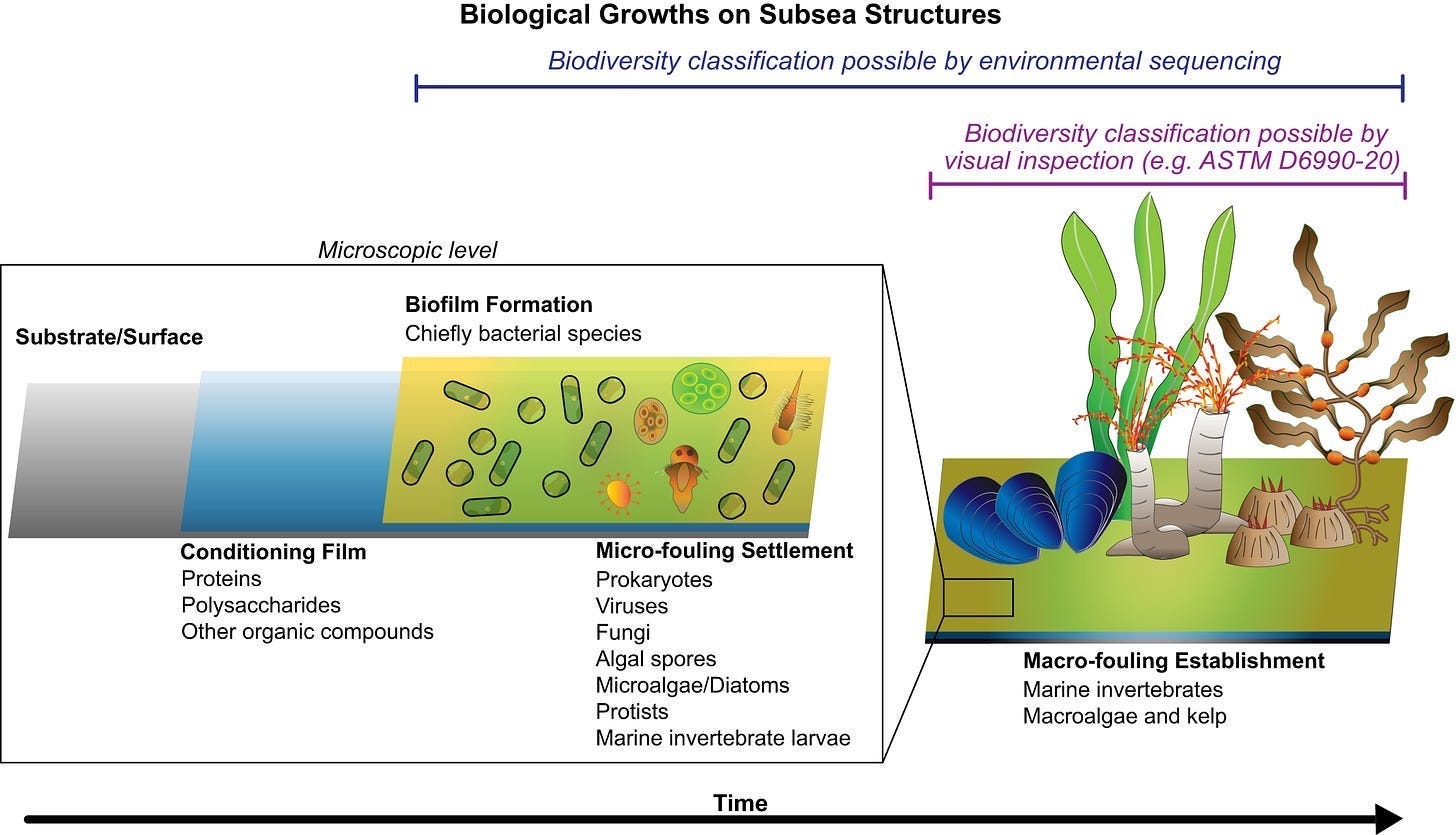

Picture 6 - Micro vs Macro biofouling, Source

Now that we have described the process, it is also essential to understand the jump and the difference between the two key stages, and Picture 6 shows this transition perfectly. As I stated, the cycle initiates immediately upon immersion with the formation of a conditioning film, the molecular layer of proteins and polysaccharides that acts as the base for colonization. As picture 6 highlights, this rapidly evolves into biofilm formation, creating a microbial slime layer populated by bacteria, which heavily promotes barnacle settlement.

This microscopic phase is critical because it is the foundational glue that enables larger organisms to attach, and it opens the gate for hard-micro fouling, which is the more serious issue, as it causes the most negative effects for ships. Once the biofilm conditions (prepare) the surface, it invites macro-fouling establishments, the settlement of hard-shelled invertebrates (barnacles/mussels), and soft macro algae.

One of these macro-fouling establishments (and one of the most important) is barnacles, which hold the key to the transition from micro to macro fouling.

Now let’s get to it.

3.3 - How larvae get into the picture

So now that biofouling and its key stages are covered, let’s explain the specific niche that ITECH focuses on, which is repelling, without killing, Cyprids that are responsible for the barnacle creation.

Barnacles don’t just randomly attach themselves to the ship, it is a process.

The journey begins as a microscopic larva called a Nauplius. It floats freely in the plankton, eating and molting, at this point, it poses no actual threat to ships, but that soon changes.

Nauplius evolves into a Cyprid (Picture 1), which is hardwired for a sole mission —> to find a favorable surface, attach, and then multiply fast. Cyprid’s uses two antennules (small sensory appendages) to walk across the ship’s hull. It tests surface texture, chemistry, and biofilm to determine suitability to settle. As explained in the previous chapter 2, they are chemically attracted to the biofilm (the green slime), and they aren’t fast swimmers, thus they target massive and slow-moving hosts. This makes ships the perfect targets (specifically tankers, which spend a lot of time idle, this is why Selektope's prominent use case is idle tankers).

Ship hulls are the ideal habitat for these organisms, as they are chemically attracted to the slime (biofilm) you saw in Picture 4 because it signals a food-rich environment to begin mating. Cyprids are not just randomly swimming and bumping into ships, they are actively hunting for the specific chemical and physical characteristics of ship hulls (Source).

So, in essence, microfouling sets the stage for Cyprids to attach to the ship!

Picture 5 - The vicious cycle of barnacle formation, Source

When they start attaching to a surface, it is game over. Not only do they multiply vastly and very quickly, effectively filling the hull, but they also undergo calcification, a process in which they chemically fuse their bases to the ship’s surface with an adhesive strength (fun fact it is one of the strongest natural glues) so high that mechanical removal frequently strips the underlying anti-corrosive paint, damaging the hull itself.

3.4 - Selektope Function & Application

How do you solve this problem?

Selektope —> It acts as the booster and not the whole end-to-end solution, it is the chemical that prevents cyprids from attaching themselves to hulls when applied to the hull of the ship. Thus, preventing barnacle creation and formation.

To make it clearer, I edited Picture 4 so it is evident that you can’t, for example, use Selektope to stop biofilm formation. Selektope targets the very niche but crucial aspect of barnacles.

Picture 4 - The function of Selektope, Source - Design by me

After reading many of the comments on the company, there is a misconception that it is an operational risk not to cover the full spectrum (Althought it does limit the TAM). Observing the available solutions, it is evident that no single solution covers the end-to-end procedure, imagine that the available solutions are ingredients in a chemical cocktail.

To give an example of 2 standard cocktails used by one of its biggest clients, CMP uses the following:

A. Cooper free paint - Selektope for barnacles + Econea for slime and algae, as well as a polymer binder (will explain what binders are) to control the release

B. The High-performance line - Cuprous Oxide, which is basically Copper, the base for covering the general biofouling + Selektope + Zinc for slime

3.5 - Prevention is the solution to all problems | How Selektope Works

I believe it has been established that if Cyprids start attaching to the ship’s surface, it is already too late, so how is this issue solved??

When the barnacle Cyprid larva encounters a surface containing Selektope, then Medetomidine, the active ingredient in Selektope, targets the nervous system of cyprids via molecules that leak out in minute concentrations (nanomolar levels) and bind to their octopamine receptors (think of this like an adrenaline button that medetomidine pushes) and makes cyprids kick instead of attach.

The larvae need to be still and use their antennules to explore a surface before secreting cement to attach, the induced hyperactivity forces them to swim, preventing them from settling onto the hull. Effectively, they move themselves out of the hull, making it impossible for them to settle without the need to kill them (no negative effect for the environment). Worth noting that this effect is reversible after a bit of time, and degradable as well, and Metedomine does not bioaccumulate in marine species nor hurt Cyprids.

In contrast, the most common solution is carbon dioxide, which kills Cyprids. And there has been a lot of talk recently about whether it is the best available environmental solution.

3.6 - The issues caused by Biofouling

Okay, the science is very interesting, but what about functionality?

With every product or service, you need to address a problem and make the customer’s life easier.

So, how does Selektope improve its clients’ operations?

‘‘The Big Drag’’

Independent research reports, even when conservative in their estimates, found that biofouling contributes to over 110 million tons of excess carbon dioxide (CO2) emissions annually. This is intriguing. How is this plausible?

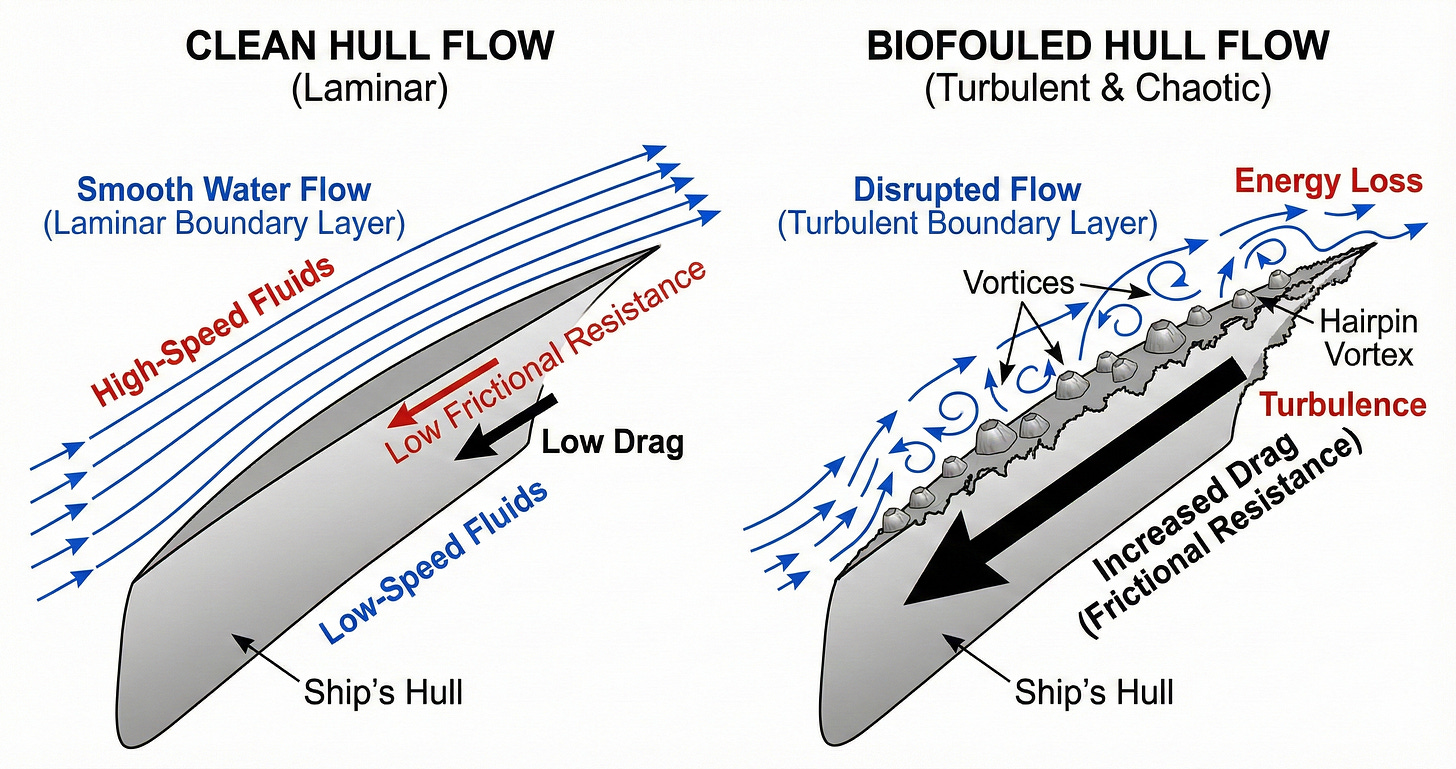

In stark contrast, the early stages of microfouling, such as microbial slime, contribute only to baseline hydrodynamic drag. Barnacles are the heaviest (you will see why) problem the marine industry is facing.

Selektope mainly targets the complex fouling niche, as it helps in the following.

Speed improved

Money saved

Environmental goals & regulation

Saves up damage from cleaning

But let’s be a bit more specific, shall we?

Frictional resistance accounts for most of a ship’s total resistance, up to 70-80% for large, slow-moving vessels like tankers, which are our focus as these are, for now, Itech’s clients. This resistance is a function of the wetted surface area and the hull’s smoothness.

Biofouling, specifically hard fouling, acts as a significant surface roughness factor. However, unlike simple mechanical roughness (like paint), barnacles act as turbulators, even small barnacles at 2-5mm in height (we aren’t even taking the worst-case scenario here) are big enough to poke through a layer of smooth water that clings to the ship’s hull. This disruption causes the water flow to become chaotic and turbulent, acting as a brake on the vessel. Instead of propelling the boat forward, the engine energy is wasted fighting this turbulence, resulting in a drastic increase in drag, to showcase this effect, I made picture 5.

Picture 5 - The Turbulent Flow, Source - Design by me

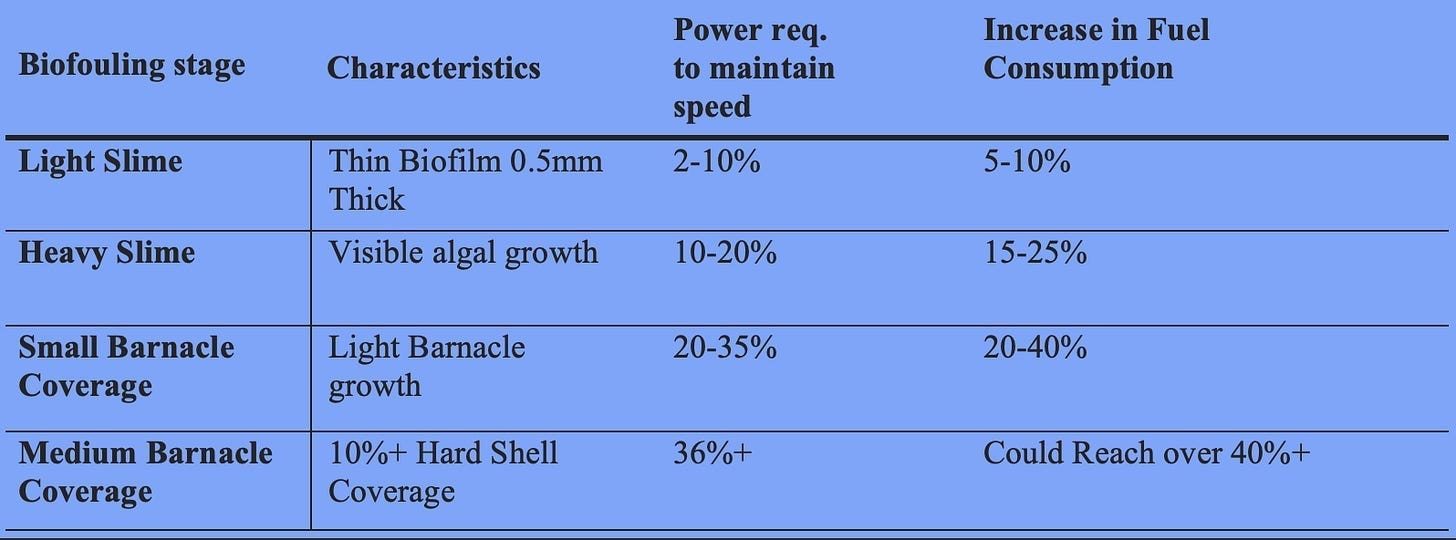

So here is how specific stages of biofouling can affect speed & fuel.

Sources - For this board, Source 1 and Source 2 were used.

The industry rule of thumb, supported by these studies, is that 10% barnacle coverage requires a 36% increase in shaft power to maintain the same speed. This is a non-linear escalation, a small amount of fouling (hardly visible from the deck) is able to negatively effects the vessel’s hydrodynamic efficiency.

When it comes to stopping speed, heavy fouling can reduce ship speed by up to 20% under constant-power conditions. This creates a vicious cycle in which you must use more fuel to keep the same speed, and that would be the case if the vessel weren’t filled with barnacles.

The fun part?

From vessel dry-docking (a process in which ships undergo maintenance), attendance over four years has revealed that more than 40% of vessels had over 10% hard fouling coverage on the hull, increasing CO2 emissions by millions of tons.

Also, if someone opts for the cleaning option, it doesn’t seem like the best solution.

To remove calcareous fouling (barnacles), divers use stiff wire brushes or high-pressure water jets, while it eliminates barnacles, it also removes thickness from the soft antifouling paint.

A single aggressive cleaning can remove 6-12 months’ worth of paint thickness, so. If a vessel is cleaned multiple times, the antifouling coating may be completely worn away, exposing the anticorrosive primer or bare steel years before the scheduled dry-docking. That, of course, increases the potential for damage and fixes that need to be made.

Even if the paint survives, the cleaning process leaves the hull rougher than before, with brush marks and remaining barnacle base plates that are extremely difficult to clean. A rougher hull attracts fouling more quickly, leading to a doom loop of more frequent cleaning and accelerated degradation.

To showcase an example, using a bulk carrier burning 40 tons of VLSFO (Very Low Sulphur Fuel Oil) per day for USD 600/ton, we get the following numbers,

In a clean hull, the daily fuel costs = $24,000 (estimation)

Just a 10% barnacle coverage (+36% Power/Fuel), so daily duel adjusts to = $32,640.

This means that the daily loss is $8,640!!

Annual Loss, making a logical assumption of the standard 250 sailing days, comes around to $2.16 million JUST FOR FUEL (to which I remind everyone is a low margin industry). Now imagine that most shipowners do not have a single ship but rather multiple ships.

As always, I like to verify with independent sources, as some of the studies have been funded directly by ITECH, which I find completely logical, since it is, in general, an issue that has been getting more and more attention in recent years and does not have a vast bibliography.

There are many independent sources (Unrelated to ITECH) that confirm very similar findings,

USA Navy - Source

The overall cost associated with hull fouling for the Navy’s present coating, cleaning, and fouling level is estimated to be $56M per year for the entire DDG-51 class or $1B over 15 years.

IMO | United Nations - Source

A layer of barnacles on a container ship can increase Greenhouse Gas (GHG) emissions by up to 55%.

KTH Royal Institute of Technology - Source

The physical presence of barnacles creates “form drag” (turbulence picture), which is far more damaging to momentum than simple surface friction.

Besides, barnacle growth on the hull can affect other areas of the ship and reduce engine performance.

Picture 6 - Source ITECH

The environmental aspect should not be ignored, as it is crucial to the adoption of Selektope. The IMO and the EU’s climate directorates demand extreme vessel efficiency to lower greenhouse gas (GHG) emissions.

The argument here is straightforward —> if barnacles force ships to use much more fuel to maintain the same speed, then CO2 emissions will increase.

So, let’s check the Barnacle Tax.

The key figure here is ETS, the European Union’s carbon-pricing mechanism that imposes a cost on greenhouse gas emissions. For shipping, vessels must purchase and surrender emission allowances for each ton of CO₂ they emit on EU-related voyages, 100% for intra-EU routes and 50% for EU–non-EU routes. (The regulation in Europe is genuinely innovative, best joke in the thesis?)

The market sets the price of these allowances. It increases over time as the emissions cap tightens, meaning higher fuel consumption and lower efficiency directly translate into higher regulatory compliance costs for shipowners.

A vessel with moderate barnacle fouling pays an additional fee of approximately upwards of €327,000 annually (per ship that is) in carbon compliance alone, on top of the $1.8 million+ in excess fuel (fuel depends on the ship, cargo weight, etc.)

Selektope and biofouling products help achieve those goals, so ship-owners don’t have to pay more.

The oxymoron here is that the same organizations that promote environmental rules and restrict CO2 emissions are the same ones attacking innovative solutions like Selektope.

So, the conclusion is that the problem is real, verifiable, and material for the marine industry.

Chapter 4 | The Business Model

4.1 - The Business

Dropping my marine biologist PHD it is time to get into business specifics,

I-tech employs a B2B business model, in which it completely outsources its production to contract manufacturers (better margin %), allowing I-Tech to focus on sales, R&D, and regulatory scrutiny.

Selektope is sold in powder form. The powder is produced in pharmaceutical-grade facilities operated by contract manufacturers.

Then the 6 Marine paint companies (out of the big 9) receive this powder and incorporate it into their paint formulations, along with other co-biocides. Once the blending is complete, the formulated paint is sold to shipping companies, the end-customers, who in turn transport it to the docks. At the docks, the paint is applied to ships’ hulls, ensuring highly effective fouling protection.

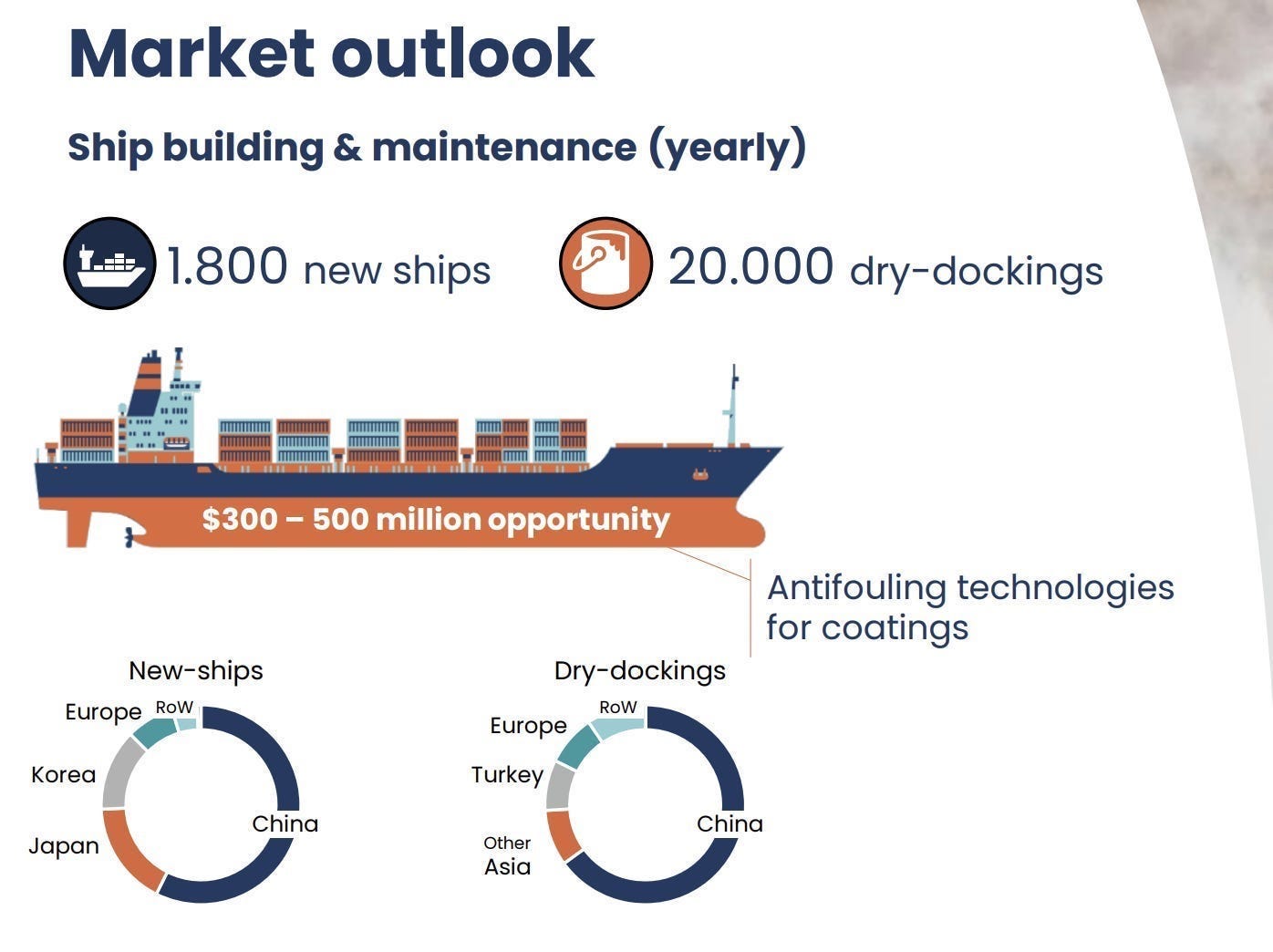

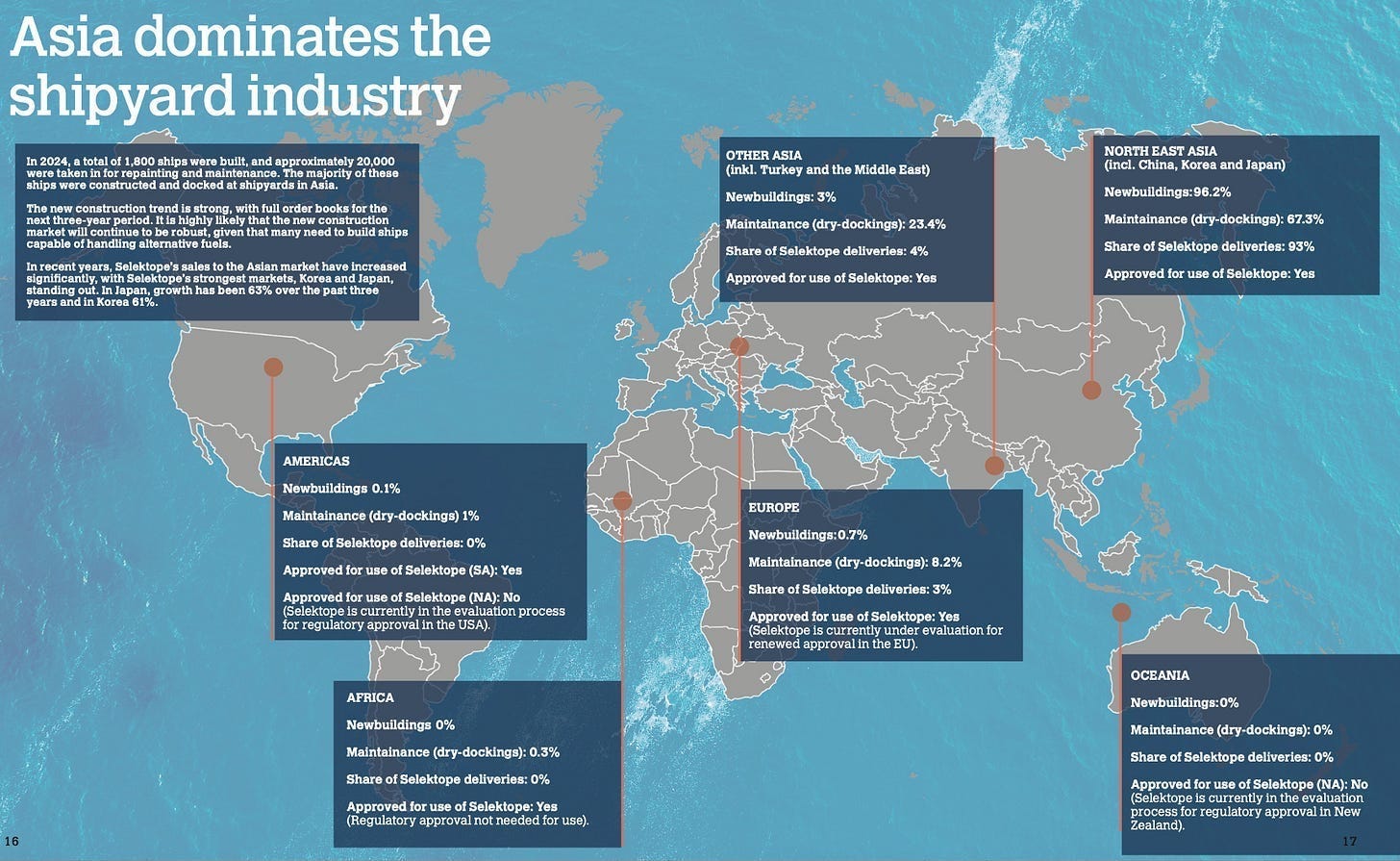

Picture 5 - Industry Stats, Source ITECH

The coating market is based on two key fronts.

New builds = Means a new vessel to be or which has just been constructed, or is under construction, in which a member of the Company Group has agreed to acquire.

Dry-Docking = The procedure in which ships get out of the water into a basin or floating structure to allow workers to access and service their entire hull and underwater components for essential maintenance, inspection, and repairs, such as cleaning, painting, fixing propellers, and checking for structural integrity, ensuring the vessel remains safe, efficient, and compliant with regulations. This progress is mandatory and takes place on average every 5 years.

In my view, Dry Docking is far more critical in this case, as every year 1.500-2.000 ships are built, but 10.000-15.000 dry dockings take place PER YEAR, as the global fleet is close to 10x the raw volume of new builds.

Besides that, the most critical angle here is that new builds are very susceptible to the cyclical industry of shipping, which means that during the slower years of the industry, volumes of new builds drastically decrease, and if you base your business model around them, the cyclical effect on your revenue will be felt. On the contrary, dry dockings are 100% obligatory, and there is really no choice for ship owners to do them or not, improper maintenance can get ships banned from ports and result in massive fines.

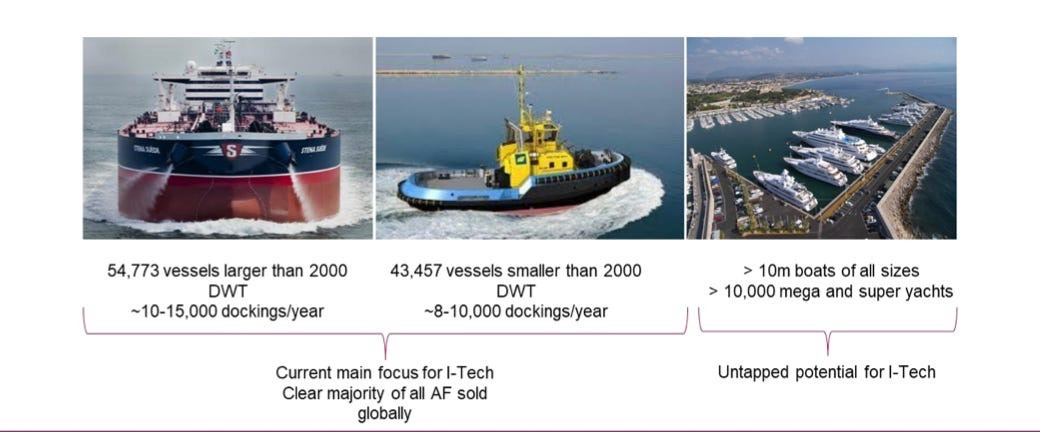

As of now, based on information I gathered it seems ITECH has a firmer grip on the new-build market vs. dry docking. The latest available data from the company shows that they are used on 3,000+ ships (Q2 2025). For reference, one year ago, the figure was about 2.500 in April of 2024. The penetration trend is moving positively.

Worth noting that, at the current stage, their clientele is mostly Tankers and Cargo ships, they are the targeted audience, as they are the ones that suffer most from barnacle penalties due to their structure and profile.

4.2 - Client Acquisitions Process

The process of getting new clients is relatively slow. First, as I have already covered, it is a small industry with limited players, 9 companies control 80%+ of the whole market. On average, it can take up to 10 years to win a new client (industry standard).

Even when a client is closed, the process is still slow because the paint maker runs various tests to confirm biocide efficacy across several biofouling cycles (a few years). Then, further development takes place with a handful of selected formulation candidates.

If successful, one or two candidates may be tested on ships (test patches, as shown in the picture I posted in the intro). It takes about 2.5 years before making the final decision. On a case-by-case basis, larger or even full-scale tests can be done to confirm the industrial attributes of production and application, so we

This happens as an antifouling product (like Selektope or ECONEA) need to operate across different environments, at different ship speeds, and at different water temperatures, which can significantly affect biofouling intensity and formation rates (for example, in warm waters, it is much more intense). The whole process includes support with chemical technical challenges and guidance on the ultimate use of Selektope, together with the company’s engineers and specialists.

Chapter 5 | Opportunities & Trends

Expansion of TAM & Product Lines

Okay, so TAM is exciting in this thesis as it operates on two fronts.

A - Getting access to more of the Big Paint Companies

B - Penetration of product lines within the same partner | Paint companies do not have just a single line of paint, they have multiple with different formulations based on client needs/goals. This is important, and I will touch on it again later.

Source - ITECH Old investor presentation.

The global fleet of larger ships consists of around 110.000 ships. ITECH is used in about 3.000, so penetration is low and there is a lot of room. As far as the TAM picture goes, I believe we should focus mostly on the left cohort, it is a bit too early for the smaller boats and unlikely to go fully commercial soon. As it stands, even if we assume 55.000 as the TAM, there is plenty of room to capture, especially in the dry-docking leg.

The real value creation is happening in the R&D labs of key partners as they reformulate their lines to include Selektope. If it starts moving towards the higher-volume lines (currently it’s mostly included in premium lines), it could be a nice thesis upgrade.

This fits with the trend in which Copper has started to be more strictly regulated (mostly on environmental effects), and manufacturers MUST add a booster to maintain anti-fouling performance. Selektope remains the most effective solution by both weight and performance.

Growth Opportunities via Expansion

According to the Q2 + Q3 transcript, as well as the interview on this deep dive with Markus, which you will read in a bit. We should likely expect the following in the future

More products with Selektope

Additional features on Selektope mean it will require fewer additional components to be used alongside it in the mix.

Expansion on new verticals like solutions for Offshore Energy as well as Aquaculture.

No info yet on when they will contribute.

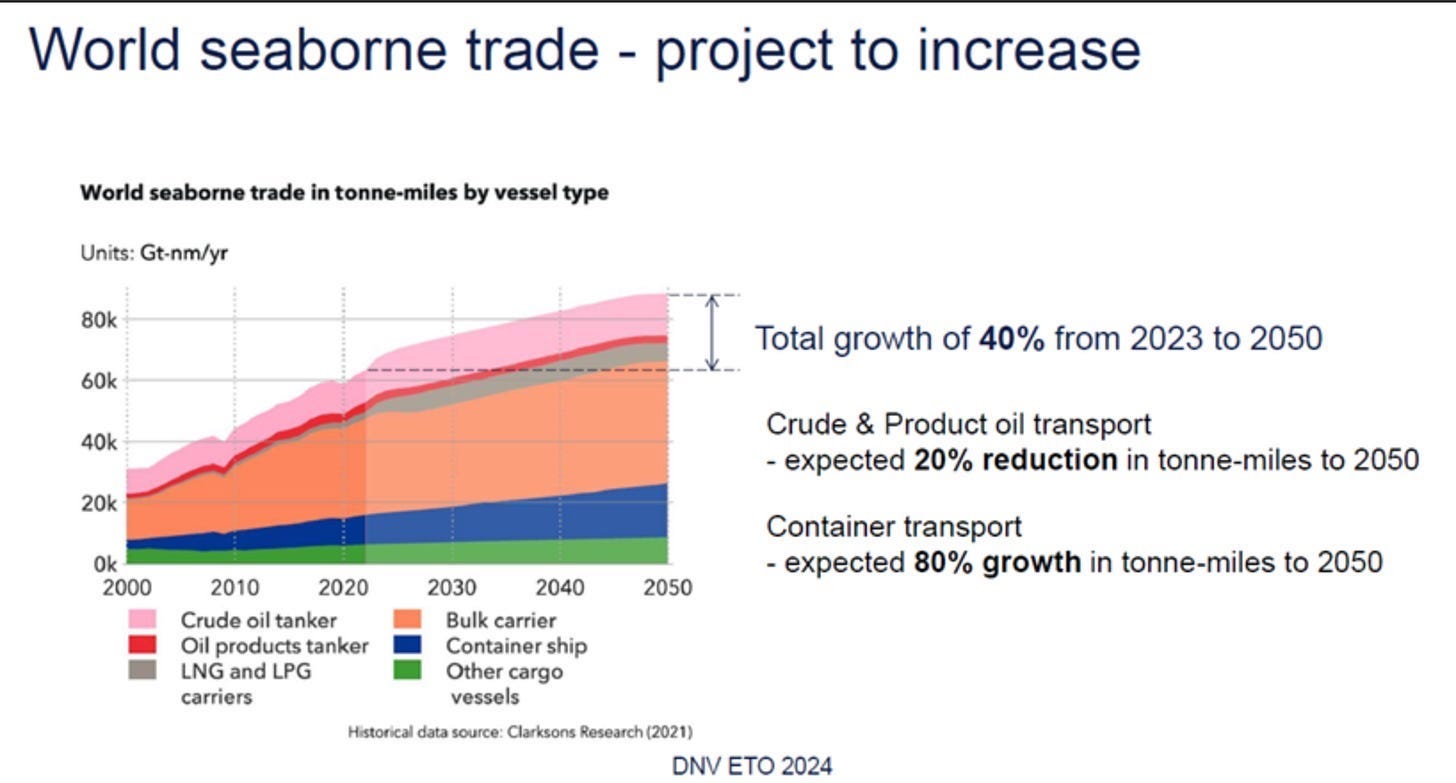

Trade Trends

The 40% increase in total seaborne trade by 2050, serves as a tailwind for the antifouling industry simply by expanding the TAM (the mindset here being more tonnage miles equals more hull maintenance). Also, the composition of the fleet is shifting while crude and oil product transport is expected to shrink by 20%, container transport is forecast to grow by 80%.

This shift specifically could favor Selektope because the massive increase in container volume often leads to port congestion and longer waiting times at anchor the exact static conditions where barnacles attach. As already covered in the report, it performs the absolute best in idle environments. Here, I could also add that rising global tensions and tariffs can affect idle time, which benefits the use case.

Any drag caused by fouling destroys profitability and hampers compliance with strict environmental regulations. As trade volume grows, the pressure to reduce emissions per ton-mile increases.

Copper prices

As always, it all comes down to money and how shipowners can achieve the desired/best outcome with the least amount possible. After all, it is a low-margin business, and costs matter.

A standard high-performance antifouling paint can contain 40-50% cuprous oxide by weight. Given how recently Cooper prices have surged, that means that the raw material cost for a copper-based paint has surged, too. Paint manufacturers operate on thin margins and struggle to pass these costs fully to shipowners, in my view, this trend improves the economic case for Selektope.

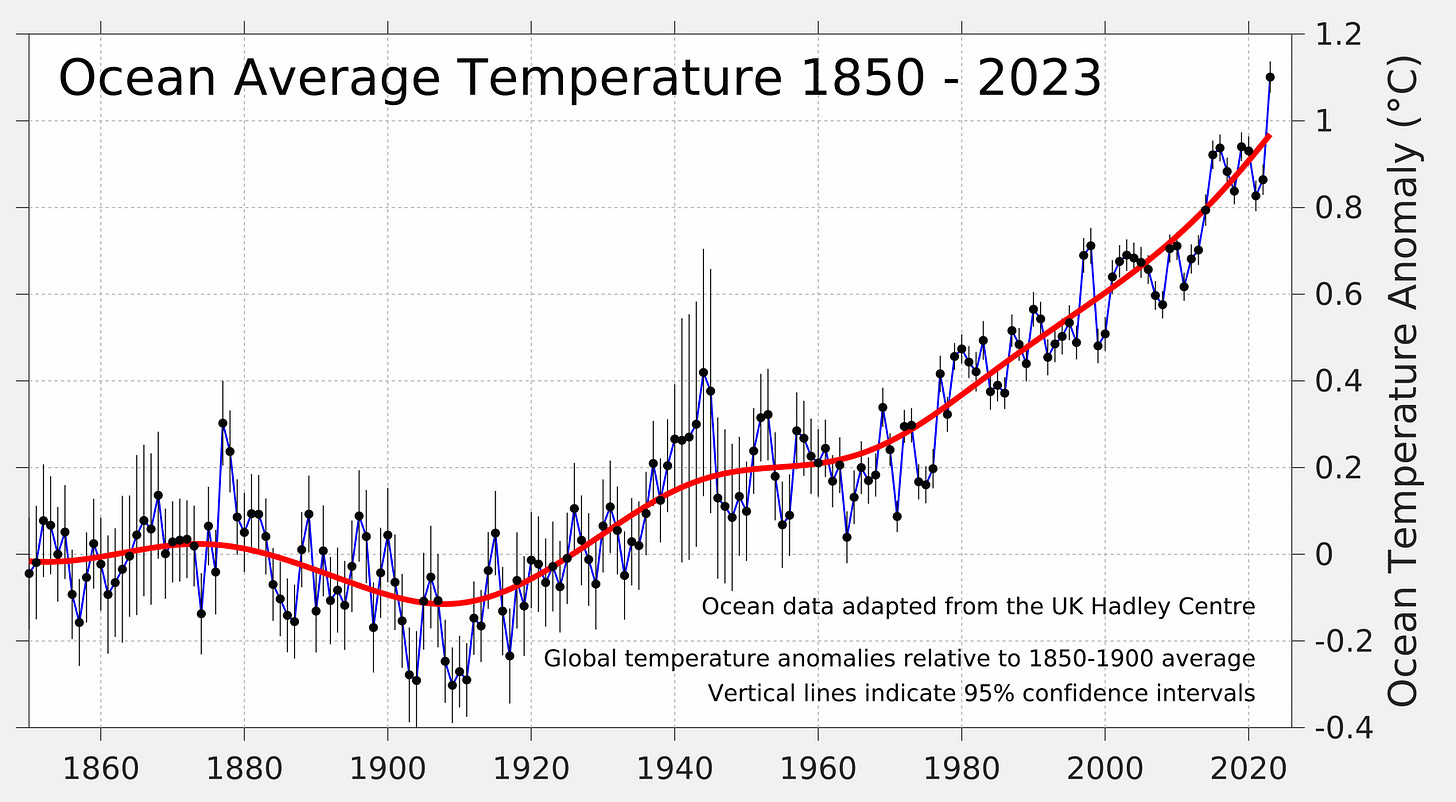

Warming Oceans

Fouling pressure is continuous and much more intense in tropical waters and warmer oceans. Barnacles can reproduce year-round, and larvae can metamorphose and settle within days. In high-risk areas, a clean hull can be colonized by hard shells within 1 to 2 weeks of becoming static.

As seen in the chart made by Berkeley Earth, a California-based non-profit research organization, oceanic temperatures are extending and will continue to do so.

Even more recent data from NOAA indicates that August 2024 and 2025 saw significant positive SST anomalies across the Northern Hemisphere. The Arctic Ocean and North Atlantic have warmed by ~0.3°C to 0.4°C per decade.

A vessel that idles for just 14 days in these waters without specialized static protection faces a very high probability of accumulating hard fouling that can permanently degrade its performance until the next drydocking.

Increased temperatures = Increased Biofouling = Increased need for solutions

High Barriers to Entry

Biocides are heavily regulated (a double-edged sword, as we will examine later) in the most important jurisdictions, such as the EU, Asia, and the United States, and obtaining approval for use as a biocide can take over a decade of research and regulatory proceedings, with no guarantee of success. This was confirmed to me by Markus (CEO), who stated.

Since 2012, the EU has authorized, I believe, only two new coating products under the BPR (Biocidal Products Regulation), a signal that the regulation is not working as intended. It seems the regulation is blocking innovation, as more effective products are not allowed to reach the market.

I am also sure that ECHA's recent stance is discouraging new entrants and aspiring competitors.

This, in combination with I-Tech’s access to utility and manufacturing patents for its product, means the barrier to entry for new competitors is very high. As regulations have grown increasingly strict and the number of approved biocides has dwindled, the demand for the remaining approved substances has increased.

I found it unlikely that the company is in danger from new entrants, as they would have to spend years and millions on R&D, navigate brutal regulations, and gain the trust of 6-9 key players to switch to their product.

Trust and reputation are very important factors in their industry.

Buybacks

The company trades at a historically low valuation (for reasons that we wil discuss). So far, they have not been allowed to make share buybacks due to regulation (NQ North, ABL19, §13). However, there is a proposal to change the rule by the end of 2026. If changed, the share buy-back could become an option.

Chapter 6 | Risks, Headwindgs & Competition

6.1 - The Standard Risks

Lack of diversification

There is an evident lack of variety in product offerings. By the time this deep dive is written, Selektope accounts for 100% of operating income.

When your entire revenue is tied to a single product that is also under threat in the EU, a lower multiple will naturally be applied until revenue diversifies. Worth noting, there are plans for a new product/product.

Lack of alignment

Insider ownership can be a double-edged sword, but I tend to favor companies with some, or generally high, insider ownership to incentivize performance and ensure that all actions are favorable to shareholders.

The most significant insider stakeholder is Philip Chaabane, the chairman of the board and ex CEO, who owns 3.68% of the shares.

Soft signals from the management are positive, and dilution is close to 0. At the 2025 AGM, shareholders voted to allow 10% dilution if needed (not material/standard practice).

Execution

An essential part of the thesis lies in ITECH’s ability to launch and introduce new products hinted at over the last 2 earnings calls. While they have an advantage due to existing client relationships and networks, the company has never launched another product line, let alone a successful one.

Even if successful, it could take a while for those new products to have a material effect on revenue.

Client Concentration

So, this is a risk, but also an unavoidable reality, as ITECH cannot really do anything about it. While there are thousands of paint manufacturers, 9 of them account for 80-90% of the global anti-fouling market.

To put it simply, your tanker needs painting now, or in 3 years it must use one of the 9 key players, there is no other available option. That is also a double-edged sword, if you basically integrate yourself into the cocktails of these players, it would be tough to get replaced. But if you lose one of them, the effects on revenue will be felt.

Additionally, if a client faces financial difficulties, this could also drastically affect growth rates, as we are currently observing. Worth noting that they have never lost a client, and they have been used in more and more product lines.

Cyclicality

Their revenue is tied to the paint industry, which is, effectively (yes, I like to use that word), a cyclical business, partly that is, a minor spoiler for later.

That means revenue fluctuations are very likely to occur in response to how the shipping industry performing, especially when the are more prominent in new builds vs dry docking.

Talent Retention

Currently, the company has a team of 13 people, which is very efficient, as revenue and employee metrics are very positive. But losing a key person will likely affect productivity, especially in the regulatory affairs department.

Since 2019, when the price of the level has regressed to its current level, revenue has almost quadrupled, while cash flow has gone from a loss of 5 million per year to a gain of 35 million, with practically 0 debt or dilution to shareholders. So, what changed?

But as we know, the market is forward-looking, and what has happened already is usually forgotten.

So, what is the problem/risk that has the market so worried?

Let’s examine,

6.2 - The recent Troubles

Two main reasons have caused the drawdown from the peak 124 SEK to 53 SEK are the following,

Sales slowdown

This is not the first time sales have slowed, but it is the first time we have seen a prolonged slowdown since the very rapid growth phase.

Key reason for these slowdowns - If we examine Q2 + Q3 Transcripts, we get the following data on what has caused the slowdown.

A major customer built up high inventory levels at the start of 2025 due to aggressive purchasing in Q4 2024. They effectively bought too much Selektope last year and spent the first half of 2025 using up that stockpile rather than placing new orders.

A specific “sizable customer” is facing internal financial difficulties. This customer has reduced their planned 2025 volumes because they cannot afford to buy as much, forcing them to trim production.

2025 saw the Swedish Krona (SEK) strengthen or stabilize against the USD/Euro, creating a “meaningful FX headwind” that diluted reported sales figures when converted back to SEK.

Looking Forward - As always, the main question that formed in my mind is whether this slowdown is structural or temporary.

The first thing I did was examine the list of clients to see if I could reverse-engineer who is having trouble with it, so I can assess the situation correctly. Since they are in some development agreements, which means they buy products to test but do not yet have an officially developed product, I need to understand who is having trouble with the list.

The troubled partner was from Korea, as this is where the revenue decline came from

It was also noted that ‘‘Lower volumes held back growth from a significant customer facing financial constraints, this was the main reason for weaker organic growth this quarter’’

‘‘Sales increased in China and Japan, offsetting declines in Korea, making China an increasingly important market.’’

First, CMP, Kansai, PPG, and Jotun posted very good growth and financial stability, so no worries on that front.

Although I believe it is not permanent/structural, it is the trend I will give the most emphasis to in Q4. Keeping a very close eye here.

SEK + Inventory problems are fixable. It is essential to see improvement in sales trends in the following quarters.

(After Q4, this segment will be upgraded to reflect the acuurate view)

EU issues

I will start this section of the deep dive with the good old saying that, as an EU citizen, I have observed for the better part of the last decade…

USA - Innovates

China - Imitates

EU - Regulates

This situation between the company and Europe is a topic I have covered before in another article, but new data has drastically affected the thesis.

On November 25th, we got the news that an EU draft has proposed a complete ban on the substance medetomidine, the main active ingredient of Selektope, which causes the desired effect.

The most logical question is on what ground?

The proposal relies on an earlier opinion from the European Chemicals Agency’s (ECHA) Biocidal Products Committee (BPC), which classified Medetomidine as having potential endocrine-disrupting (ED) properties.

When I first came across this, I suspect that for the EU to be that concerned, the ED potential must have passed through the water, so the scale and danger are high. They stated a potential hazard to human health, the focus was on painters who apply/handle the paint on the ship hull.

This happens as Medetomidine activates “alpha-2 adrenergic receptors” in the brain, worth noting that the effect is temporary as far as the bibliography goes.

Having already researched this topic, Itech’s argument stands on this ground.

No viable alternatives exist to tackle hard fouling

The actual effect is sedative and temporary, hormonal balance is not affected in the long term.

A ban would result in more CO2 emissions due to the increased fuel consumption.

The commission counter argued the above with the following.

Alternatives exist (cleaning robots, Cooper, etc.)

If it affects the endocrine system = ED

Health hazard > environmental goals

The research they based on their draft comes from Norway, which I read, and it is not very reliable, and it gets many parts of the science and thesis wrong.

And even though I don’t agree with the commission, it did not even consider stakeholders’ and clients’ input. This shows me clearly, even in the draft, that they are likely looking to ban it.

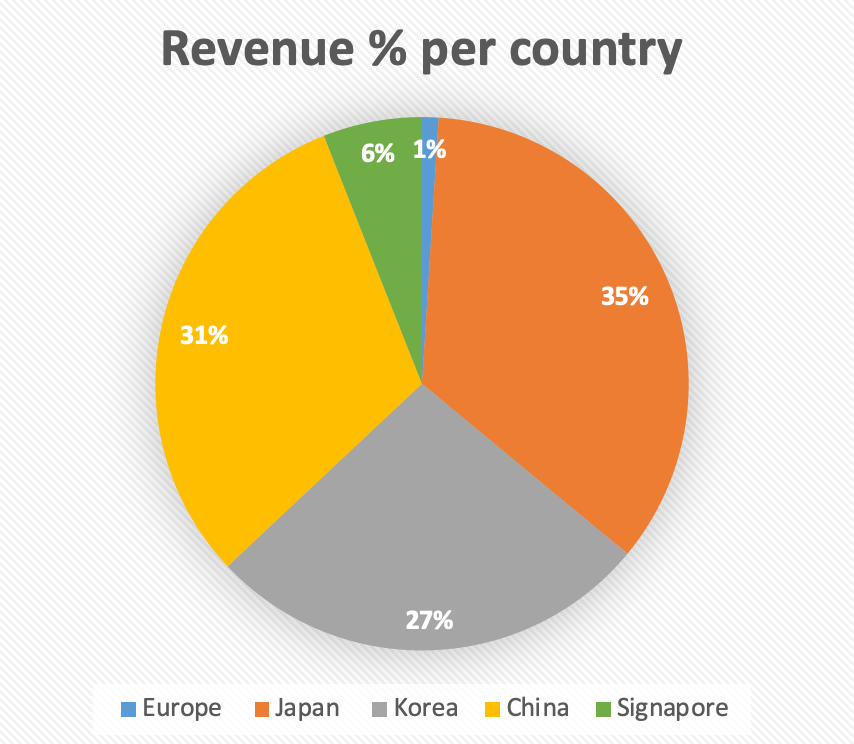

So, we need to quantify the effect on revenue, the complex data is not a concern, as currently 2% of their revenue derives from Europe and is easily replaceable.

But what about the secondary effects?

The risks of a potential ban are.

Reputation & Spillover - This is the first risk that came to mind. Okay, Europe is a small % of their revenue, but what if this triggers a domino effect in their key markets with Asia? But I would put this risk at a low %.

Regulators are much more focused on growth and innovation than on regulation.

Unlike the BPR, which operates on fixed license periods requiring renewal, Asian approvals do not have a standard expiration date and remain valid indefinitely unless regulators specifically revoke them due to new environmental findings.

The key characteristic here is that the EU operates on the Precautionary Principle, meaning something can be banned if it may cause harm, whereas, by contrast, it requires a proven environmental risk or verified damage to local ecosystems before banning a chemical. China/Korea, and Japan hold more than 90% of the global shipping market and are much more incentivized to keep high-functioning tools to ensure industries meet global efficiency/carbon targets.

Resource allocation is also a notable question if the decision turns out to be negative. Then ITECH will likely fight it, it makes sense to me. But those legal battles are costly, as they will also require ITECH to sponsor studies to support their position. And as always, the outcome in those complex legal battles is not guaranteed.

European Shipyards - Very logical, as European shipyards cannot use the paint anymore. This limits the TAM expansion. Worth noting that the front is not sizable, Europe accounts for approximately 5% of the global shipbuilding market by output (Gross Tonnage).

Important to note that ITECH recognizes revenue based on the location where the ship is dry-docked and the paint is applied. So an Asian ship that drydocks in Europe is counted as European revenue.

The economic effect is minimal, as mentioned above (2%), at least for now.

Ships that are coated with Selektope outside of the EU can enter the EU waters without any issue. This stems from the industry dynamic in which ships in international waters are governed by the flag they fly (e.g., Japan or Liberia), rather than EU law.

The EU cannot ban a foreign-flagged ship from entering its ports simply because it has a specific anti-fouling paint unless the IMO globally bans components of the paint.

In previous cases, the IMO imposed a total ban on Tributyltin (TBT), which had severe and adverse effects on the environment, as it not only killed organisms in contact with the hull but also accumulated in organisms.

Selektope degrades rapidly in seawater and does not bioaccumulate, meaning it doesn’t leave a lasting toxic legacy in the ocean like TBT. It also does not kill larvae, nor does it have a lasting effect on them.

IMO, the criteria for banning chemical substances in all previous cases are

Bioaccumulation - It does not degrade and builds up in the food chain (oysters, fish) and persists in harbor sediments for decades, poisoning the broader ecosystem.

Toxicity/ lethality to organisms and non-targets.

Extreme persistence to targets that leads to long-term environmental damage.

Selektope does not fit this criterion, the only plausible argument i could think is that ED could be classified as toxic to humans. Since it doesn’t build up in seafood (unlike mercury or TBT), the general public’s exposure risk is virtually zero. The only risk group is the painter.

On that front, there is no empirical study or evidence of prolonged exposure to actual endocrine diseases (like thyroid cancer or infertility) in humans thus far.

All the cases that were banned had a very extreme and real effect (mainly on the environment), such as visible mass sterilization in snails worldwide (TBT) and the poisoning of coral/seagrass photosynthesis globally (Cybutryne).

The EU so far takes a theoretical hazard stance (it could be hazardous, so we are banning it) Based on what I have reviewed regarding the previous cases and the legal framework, IMO, the ban is a massive, multi-decade process. In stark contrast, the EU ban is a regional regulation process (no surprises here), the risk for the ban at the IMO level is purely theoretical for the next 5+ years, even if Europe bans it into 2026.

I can be wrong here, but I would put the chance of an IMO Ban as very low, but not 0. It is the ultimate bear scenario.

Markus, in the upcoming interview on the next chapter, provides insights into the situation and potential outcomes.

Chapter 6 | CEO Interview Notes

I want to thank Markus for taking the time to answer my questions. Most of the questions revolve around the recent EU situation and the future of product line expansion.

I believe his insights are very valuable.

Summary of the Interview

EU

They can’t legally challenge a potential ban or a classification as ED until a formal decision is made. If the outcome is negative, I-Tech is prepared to challenge it

There is a risk that a potential ban comes into force (after a 6-month grace period) before the legal appeal (taking 6–12 months) is resolved.

Europe accounts for only 2% of I-Tech’s sales. The main effect of the ban would primarily hurt European shipyards’ competitiveness rather than I-Tech’s revenue.

Despite the low sales volume in Europe, He feels compelled to fight a potential ban to avoid a global reputational stigma (labeling the substance as toxic) that could eventually negatively influence regulators and customers in their key Asian markets.

The core business remains focused on Asia (China, Korea, Japan), where engagement is strong. The economic case for Selektope is strengthening as

They are in close communication with Clients/regulators in Asia to explain to showcase their arguments.

Future Plans

R&D is pivoting towards innovation in complementary technologies, e.g., new binder* materials, and into adjacent markets, such as aquaculture.

Pivot to “Binder Materials” (Havey MOU): There is a focus on new binder materials instead of new active ingredients (biocides). They aim to improve the overall functionality of antifouling paint, including its binding and performance which is very important for the clients.

Instead of developing brand-new active ingredients (which are deemed too risky under EU regulations), they are focusing on developing complementary technologies to support cocktails. These include solutions that help coating companies mix Selektope with other biocides (or create copper-free versions) more effectively. The goal here is to improve Selektope’s performance in complex, low-copper formulas.

They are looking at product applications for two specific marine sectors outside of commercial shipping, more specifically

Offshore Energy (e.g., wind farms, rigs).

Aquaculture (e.g., fish farming nets/cages).They are not currently conducting fundamental research on completely new active ingredients (new biocides) due to regulatory uncertainty in Europe, which makes it a poor capital investment. Innovation is now strictly focused on synergistic products for existing customers and adjacent markets.

Chapter 7 | The Numbers & Edge

7.1 - Revenue Analysis

Revenue analysis

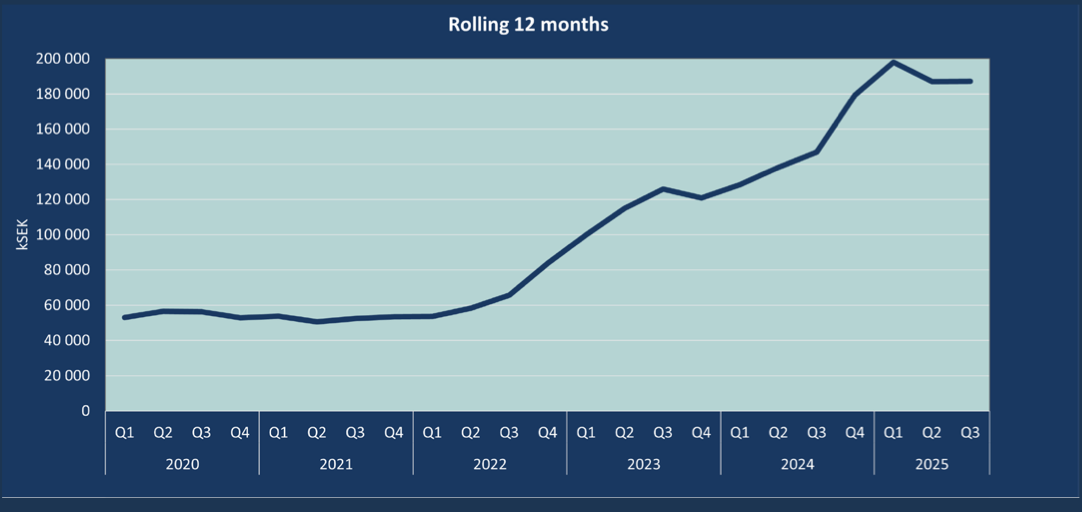

Chart 1 - Data from Koyfin + Reports, Design By me

Before the recent sales slowdown, which I covered in the previous chapter, growth was impressive, with a strong 46.5% over the 2021 - 2024 period. It reflected a period of rapid adoption and years of effort, as stated above acquiring customers and penetrating new paint product lines requires significant time, coordination, and, above all, testing.

A significant revenue trend that requires further looking, and it is not just screaming in your face, is that the client’s concentration trend has been improving, although it is still elevated. During 2020-2023, CMP accounted for 80-90% of total revenue. Then, in 2024, CMP % share dropped to <66% (implying that more than a third of sales came from others). I believe that beyond 2025, as PPG and Kansai grow their volumes, we will soon see CMP’s share fall even further in 55-60% range (still remains a client concetration risk).

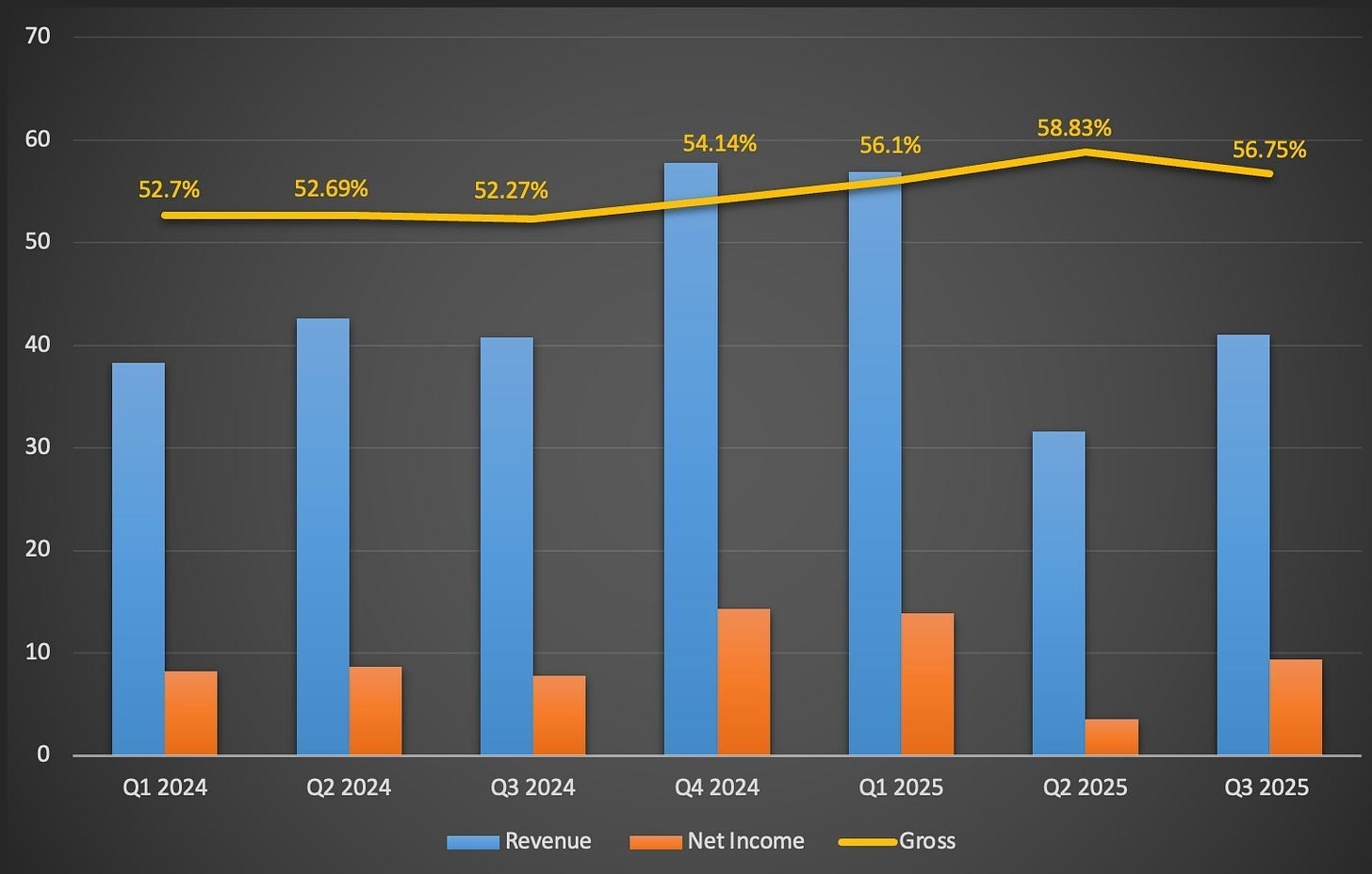

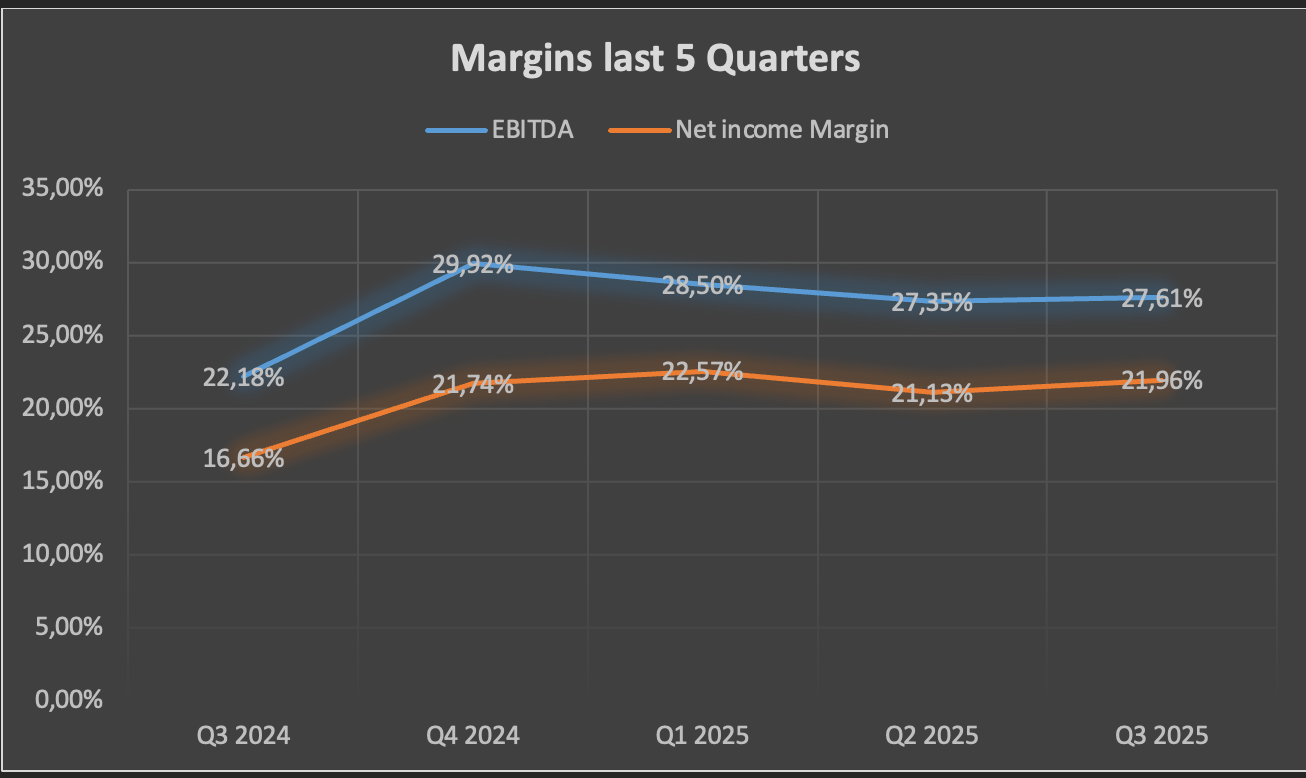

Chart 2 - Revenue CAGR & Margin Trend, Designed by me

Something that I would like to point out is the gross margin. Even though sales have contracted, gross sales saw a decent jump.

The main Driver was a change in the mix, the sales that did happen shifted towards higher-margin customers or regions.

The company also reacted as Magnus stated (CFO), they successfully put price pressure on their existing supply chain by negotiating better rates for raw materials and production, thus lowering their COGS. (Always like to see teams react)

Chart 3 - Margin Trend, designed by me

Cash conversion remains strong & Healthy, logical given the capital-light model.

Clients

Since it is a small industry,

Confirmed - CMP, Jotun, PPG Industries, KCC, Hempel, and Kansai Paint

Not yet confirmed, but likely in development - Nippon, AkzoNobel

No status - Sherwin-Williams

As far as the revenue split between them goes,

CMP - Majority

Jotun, Hempel, Nippon Paint, Kansai, KCC - Minority

We do not have specific numbers for Jotun, PPG, and Kansai, they serve primarily as upcoming, higher-growth segments.

PPG is currently the highest growing, with an increase of over 300% (smaller revenue % but still)

A vital statistic is that Selektope, while established with the key players, is still very early in its commercial penetration.

I found that approximately 36-40 distinct commercial products are confirmed to contain Selektope across all partners, and the total number of paint products is over 1,000-1,500. That means the captured TAM is about 2.4% of the total TAM.

I think they must state that one of their clients has financial issues, it does not mean catastrophe, after all, the end consumer is the ship-owner, if they find extreme value in the product, he can use another one of the key paint companies, the important thing is if the other company uses Selektope. If the painting industry has general problems that signal concerns, but after examination, most major players have reported good financial results, then it is worth noting —> The end consumer is the ship-owner.

This is a crucial distinction.

So, a few words about inventory fears, Selektope isn’t a fashion brand nor an off-the-shelf product, you don’t order it and put it in the warehouse. It’s a high-potency powder that gets mixed into paint immediately upon delivery, which means inventory levels with customers are, for the most part, low. I expect this to even out within the next few quarters. Sales growth trend is the real concern in my view.

Revenue Geography

Chart 4 - Revenue per country, Design by me data Q1 2025

Please note that ITECH usually posts the exact Revenue per location data in the Q1 and Annual reports, the Japan figure is likely a bit lower, as one of their Japan clients is facing financial difficulties, according to the data we received from Q3.

As it is evident that the overwhelming majority of revenue comes from Asia, this is not just a choice but a structural trend, as the majority of Newbuilds, as well as the overwhelming majority of maintenance (dry docks), come from there.

The picture shows clearly that they are concentrated where the majority of their addressable market is.

The balance sheet is as clean as it gets, they have 0 debt and no interest-bearing liabilities to service, meaning this cash is fully available for R&D. The company is very capital-light, as stated above, it outsources manufacturing.

Current cash on hand is 135,734,000 SEK (13.4m USD), and they have about 21% of their market in cash.

Management

Overview - Team and BOD have a lot of experience in fields that are very crucial for navigating a complex industry like shipping, the only negative I see is the lack of insider ownership.

This is not a large company in terms of manpower, they employ 13 people. Small teams tend to be very efficient (indeed, they are), but there is a high risk of losing key talent.

The standout is the relatively new CEO, Markus Jönsson, who was appointed in 2024. They didn’t go for a pure executive, and I am glad for that. He’s a business builder with a background in purpose-driven organizations, with 20+ years of technical and commercial experience across Industrial Biotechnology and Specialty Chemicals. He currently owns 20.000 shares.

The CFO is Magnus Henkell. He was previously the CEO of PowerCell (raising over a billion MC during his tenure), where he successfully managed its listing and refinancing. He has been with the company for over 9 years and owns 30.000 shares.

Because this is a company with a regulatory affairs function, it’s no surprise that the longest-serving executive is in regulatory affairs. Cecilia Ohlauson has a PhD in Environmental Science, which fits the role nicely, and previously worked in the pharmaceutical industry. She has been with ITECH since 2008, securing approvals in the EU, Japan, China, and Korea.

Markus Hoffmann, formerly the R&D Department Manager at Hempel’s Antifouling Global Center of Excellence, holds a PhD in Organic Chemistry (so he understands essential details) and has been with ITECH for 6 years. Hempel is among the Big 9, so hiring their former R&D chief is a smart move.

BOD

Philip Chaabane is the Chairman, who served as CEO for 10 years and built the company from a startup to profitability. He moved to the Chair in 2024 (smooth transition). He also holds the most significant insider stake, at 3.68%. Before joining I-Tech, Philip came from PowerCell Sweden (the same company as the CFO), where he was responsible for business and customer development.

The rest of the board background ranges from clean technology, paints and coatings, ship ownership, and finance.

Raouf Kattan will resign from the board on March 1st (retirement).

Hiring trends are stable according to LinkedIn.

Chapter 8 | Differentiating Factors / Moat

In a single sentence - It delivers the highest efficiency at the lowest concentration among all available solutions on the market. At the same time, it strongly binds to various solutions to create the best available cocktail for the client and protects against barnacles.

But let’s get more specific.

Unique approach

Selektope sets itself apart from the competition by employing a more friendly approach to antifouling. Traditional and most prominent biocides, such as copper-based biocides, which currently account for 90% of the market, often have toxic effects on fouling organisms. Selektope instead works by stimulating a specific receptor in barnacle larvae, causing temporary hyperactivity that prevents them from attaching to the ship’s hull. As we have already covered, Selektope causes no permanent damage to the larvae, and the particular mode of action allows Selektope to be effective at much lower concentrations than traditional biocides. This is important, as regulatory authorities are making efforts to reduce the number of biocides released into the marine environment, at least thats I what they state.

Concentration of the paint

So, let’s get to something interesting that most will likely ignore or consider minor when looking into the company, as stated in the entry, they have a very low concentration. So, naturally, I was very curious to see whether this was useful to their clients or just a static thrown in to impress with no actual functionality.

Returning to annual reports and a study by Chalmers University of Technology, I have the following observations.

Selektope is effective at extremely low concentrations (approx. 0.1% w/w) compared to traditional copper biocides, which often require 40–60% w/w (weight of the ingredients / total weight of the mixture).

To obtain complete protection against barnacle fouling, 0.1 – 0.3% w/w of Selektope should be used in a wet paint formulation. This equates to just 2 grams of Selektope per litre of paint, comparable to 500-700 grams of copper oxide per litre of paint for barnacle prevention.

So, to simplify, if you want to make a 10kg bucket of paint, most product lines are heavily copper-based, of those 10kg, 4-6kg will be Copper only.

A typical copper-based paint might need up to 900 grams of copper per liter of paint. Selektope requires only 2–4 grams per liter.

So, in the 10kg, you need 10 grams for Selektope (0.1% w/w)

This actually matters as,

This frees up massive space for manufacturers to improve the paint gloss, durability, or flow without being chemically restricted. Chemists have increased freedom to enhance the paint structure/synthesis which is very important.

Actually, reduces freight costs on the transportation of the paint,

So, ship marine paint is classified as a Hazardous Material and is priced on 2 factors - risk & weight. Although they function complementarily, they are very different in terms of logistics.

One typical batch includes 10.000 liters of paint, so for this batch we would have to transport and store 6,400 kg of Copper Dioxide versus 2 kg of Selektope.

The cost could be 5-10x times higher between the two solutions

3. Storage - Pretty logical given its small size

As stated above, we need both for an effective cocktail to tackle biofouling, but concentration is essential and offers a clear edge.

Ability to perform in all environments

It is not enough for biofouling paint to perform, it must perform across all environments/speeds, and temperatures as tankers move through different oceans and these factors can affect performance of the antifouling agents included in the cocktail.

As stated earlier in the report, Selektope thrives in an idle, static knot environment. Now, let’s examine why.

Traditional antifouling paints often rely on the ship moving (water friction) to polish the paint and release fresh biocide. If the boat stops, the paint stops working, and barnacles attach (source).

Because Selektope acts at the chemical receptor level (making the larvae kick and swim away, remember the button example), it does not rely on water friction to work. So ships are protected during long idling periods (weeks or months at anchor) and during outfitting (when a new boat sits in the water for months before being delivered).

Tankers do not just transport oil, but they often store it. This is a unique feature of the oil market that container ships (carrying standard cargo) don’t have. When a tanker sits at anchor for 30+ days, friction = minimal, the paint stops polishing. A layer of dead paint forms on top, and the copper stops leaching out. When the tanker finally receives an order and tries to move, the hull is covered in hard shells, resulting in massive fuel burn.

Some storage tankers stay idle for over 100 days per year. If you remember the analysis, how quickly biofouling forms and how cyprids prefer slow-moving, smooth objects, it goes to show how vital biofouling solutions are in general.

Release + Binding

Selektope binds* to pigments* and other particles in the paint system and is therefore continuously released, along with other active substances and components. This is important because it contributes to long-term performance by keeping the paint on the hull longer. The compatibility between Selektope and the paint matrix in the marine coatings industry ensures slow, steady release and secures the anti-fouling effect over time, keeping the ship submerged.

A strategic focus has appropriately been integrating Selektope with other antifouling agents to complement their effects. Currently, it is successfully working with copper and most other biocides.

*Binders = The system that acts like the glue that holds the coating together on the ship's hull to ensure the biofouling agent (Selektope in this instance) gets released into the water when the glue itself slowly wears down over time. This ensures long-term performance till the next dry docking (every 5 years if you recall).

*Pigments = The tiny solid "rocks" inside the paint that give the coating structure and act as anchors for Selektope. By physically holding onto the biofouling agent, they prevent it from washing away too quickly, ensuring a steady, controlled release.

Chapter 9 | Competitors

From my research, they operate under a competitive paradox.

They do not really have a direct competitor (at least one that is at a stage to compete with them, given their niche focus). Still, they indirectly compete with the solutions that are used side by side for more ‘‘space’’ or usage within the product lines of the paint used by the paint companies.

It is interesting as it is tough to find a one-to-one competitor to rank them side by side.

So in the sphere of hard fouling, they compete with

1. Copper-based antifouling - Most prominent and common solution in the market, used by over 90% of coatings. Recently challenged, so more solutions have been coming up. Remains in a powerful position.

2. Tralopyril (ECONEA) - The solution I consider the closest to Selektope, but has a more general application and, similarly to Selektope, is used besides cuprous oxide or other organic biocides to optimise the antifouling performance and decrease copper levels. It does not have the same intensity in terms of performance, but it is preferred for having a broad-spectrum coverage, while Selektope is more niche-focused.

3. Silicone-based antifouling - Silicone works purely on simple physics, it creates an ultra-smooth, hydrophobic, and rubbery surface with low surface energy, but has a significant weakness, it relies on speed (over 15 knots to operate correctly). So, it needs Selektope to have full coverage from barnacle protection.

Worth noting that if they expand their synergetic capabilities, as they plan to do, they would compete with the above solutions more intensly especially ECONEA.

The edge that other solutions have, like Copper/Econea, is that they can cover the full spectrum better, they can protect from biofilm formation as well as hard fouling, as stated above. Selektope thrives in the specific niche covered in the previous chapters.

As far as performance per weight at barnacle hard fouling goes, selektope is the most effective.

Important ⚠️

If you are a shareholder and want to submit feedback to the EU, please do so, as you are helping their case.

Chapter 10 | Valuation

For valuation, I examined 3 plausible scenarios that reflect 3 different and plausible paths based on penetration & spillover effect across the available product lines, as I believe this better reflects the situation. As well as the worst-case scenario. DCF with current sales trend was not the best approach in my view, as many variables/overhangs are at play at the moment.

General Assumptions

5 Next year is the timeframe, and it is more than I normally project, but I do so as the industry tends to move more slowly, client acquisition and penetration take longer due to the characteristics I have mentioned in the previous chapters.

Even when on board, it takes a while for Selektope to get adopted in more product lines.

Hanging Key risks —> Spill-over effect (this is a commercial risk), Sales Trend

Across all scenarios, the Discount rate is 13% due to elevated risk

I believe Selektope will likely be banned in Europe, and that has been included in all scenarios, growth scenarios are solely tied to the Asian markets

My projections on year 0 start from 179m SEK, which is 2024 Revenue and I believe 2025 will land near that area.

Dilution remains low/negligent, as they do not have an immediate need for cash

For reference, their current P/EBITDA multiple is 11x

A. Median Scenario

7/9 Big Paint Companies

Penetration trend – Positive

Sales Trend - Growth Back at 14% +

Drivers of that Trend: For this scenario to be achieved, in my view, Cooper Prices & Geopolitical & Environmental Trends favour them, Asian Revenue TAM remains intact, successful in the product/TAM expansion, very weak spill-over effect with stigma affecting mostly pace.

EBITDA Margin: 27% Stable

Exit EBITDA Multiple: 15

Target Price: 94

B. Bull Scenario

8/9 Paint Companies

Penetration Trend –> Very Positive

Sales Trend - Growth Back at 20% +

Drivers of this trend: For this scenario to be achieved, in my view, requires a very Successful launch of the new verticals, Cooper Prices, Geopolitical & Environmental Trends favour them, Asian Revenue TAM remains intact with no stigma or spill over effect.

EBITDA Margin: 24% Slightly lower due to scale

Exit EBITDA Multiple: 20

Target Price: 128 SEK

Comments: The slight margin contraction here is very natural, as with scale, I suspect margins will contract but not by much. Keep in mind, they are currently used in more premium lines that command higher margins.

C. Bear Scenario

Sales Trend –> 4%

Penetration Trend –> Negative

Divers of this trend: For this scenario to play out, it means that the spill-over effect is intense, and stigma is present, which means Selektope struggles to get adopted and stays mostly in premium lines and likely slowly withers at some point.

EBITDA Margin: 18%

Exit EBITDA Multiple: 7

Target Price: 34 SEK

Coming Catalysts

5th February - Earnings, Look out for

Sales Growth Trend

Commentary on new launches

H1 of 2026 - Regulatory Ruling

Negative or positive decision (I lean towards negative)

ITECH’s reaction

Final Chapter

I believe I-tech is an interesting company struggling with regulation. I think fears for the EU event are somewhat overblown, the real risk is IMO’s stance, not Europe’s.

For me, the real essence of the thesis is

Sales trend improves

Manage the spillover effect

Penetrate new lines and expand its current product catalogue to become something more than a super-niche player in the biofouling field.

According to how the case/variables play out, the value falls between 32 and 128 SEK,

Remains very high in my watchlist, and I will be watching Q4 closely, especially for the sales growth trend.

Hope y’all enjoyed this report!!!

Please remember to like this article, and if you have questions, I will happily answer them in the comments.

Sources Used for this report

A. Directly from ITECH

Their studies on fouling (highly suggested)

B. Indirect sources

Global Temperatures 1 - Berkeley

C. Financial Data

Koyfin

Disclaimer ⚠️

This report is sponsored by ITECH, which means Simeon Capital has been compensated for the production and the time to produce this report. While Simeon Capital was compensated for the production of this material, ITECH did not exercise editorial control over the specific content or the opinions expressed herein. The analysis, views, and conclusions presented are strictly my own and have been drafted based on my independent assessment of available information.

The information provided in this report is for informational and educational purposes only. It does not constitute investment, legal, or tax advice. The author is not a financial advisor, and nothing in this report should be interpreted as a recommendation to buy, sell, or hold any security. All investment involves significant risk, including the loss of principal. Simeon Capital and its authors do not hold a net long or short position in the issuer’s shares exceeding 0.5% of the total issued share capital.

This report contains “forward-looking statements” within the meaning of applicable securities laws. These statements are based on the current expectations, estimates, and projections of the company’s management and the author’s own analysis. Words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” and “will” identify these statements. Forward-looking statements are not guarantees of future performance and involve known and unknown risks and uncertainties. Actual results may differ materially from those expressed or implied in this report. Neither the author nor the company undertakes any obligation to update these statements as circumstances change. While the author has made every effort to ensure the information in this report is accurate as of the date of publication, it is provided “as is” without warranty of any kind. Information will become outdated or may be based on third-party sources that have not been independently verified.

Great work. I learned about barnacles and fouling.

How much time do you spend on research and writing? This is a true deep dive, pun intended.

Great research! It’s been on my wishlist for some time. While valuation has come down I’m in general allergic to single product and high customer concentration cases. Regulatory spillover effect is not pleasant either right now. It deserves a high risk premium. If that is considered is it really that cheap on these levels?

On the other hand, once more proven, one could argue the company would be better suited to be part of a larger group - but difficult to build the case around that as always.

Tough comparables for Q4. I will await the next report.

Many thanks for great work!